Survey: The Staying Power of Smartwatches…and What It Means for Apple Watch

Just how diffusive will smartwatches become among American consumers? Time will tell. But with all the buzz surrounding the release of the Apple Watch, Field Agent conducted a survey of over 300 smartwatch owners to determine the staying power of these high-tech timepieces. Moreover, we asked respondents about their attitudes and purchase intentions toward the new Apple Watch. Taken together, the results may shed light on the longevity of smartwatches in general as well as the sales potential of Apple’s newest innovation.

Timepieces have come a long way since the sun dial. Pocket watches, wristwatches, calculator watches, and, now, the latest evolution in the timepiece: the smartwatch. Even smartwatches, relatively new in the overall scope of things, have evolved significantly in recent years. And the new Apple Watch is promising to incorporate what we’ve come to expect of smartwatches—accelerometer, text/call screening—while adding its own unique features.

But do smartwatches have staying power? And will the Apple Watch attain success on the level of other Apple products, such as the iPod and iPhone? In other words, whether for smartwatches generally or the new Apple Watch specifically, is time really on their side?

Instead of talking to consumers in general, we went directly to the source, specifically targeting current smartwatch owners with our latest survey. We surveyed 301 respondents from across the country, seeking to understand a variety of smartwatch attitudes—satisfaction levels, brand loyalties, purchase intentions, etc. Several different smartwatch brands were represented in the study; most common were Pebble (22%), Fitbit (20%), Samsung (19%), Motorola (8%), and Garmin (7%), among 16 brands total.

See Also: How 'Cord-Cutting' Millennials are Changing TV Forever [WHITEPAPER]

Here are 5 quick takeaways from the study:

1. Smartwatch satisfaction runs high

Fully 77% of respondents said they are “completely” or “very” satisfied with their current smartwatch. An additional 21% reported moderate satisfaction, leaving only 2% (just 7 respondents of 301) on the low end of the satisfaction scale.

Respondents told us there’s a lot to like about their smartwatches in general. Not surprisingly, owners of fitness brands (e.g., Fitbit) were generally most vocal about the health benefits of smartwatch ownership. For instance, as a 23-year-old female from Akron, Ohio told us, “My health above all [is the greatest benefit]. Tracking my steps keeps me motivated to do more. When paired with apps such as Pact and Myfitness Pal, I feel truly in control of my weight loss goals. It's an awesome resource that I use every day!”

!["My health above all [is the greatest benefit]. Tracking my steps keeps me motivated to do more. When paired with apps such as Pact and Myfitness Pal, I feel truly in control of my weight loss goals. It's an awesome resource that I use every day!" - 23 year-old female from Akron, Ohio "My health above all [is the greatest benefit]. Tracking my steps keeps me motivated to do more. When paired with apps such as Pact and Myfitness Pal, I feel truly in control of my weight loss goals. It's an awesome resource that I use every day!" - 23 year-old female from Akron, Ohio](http://blog.fieldagent.net/hs-fs/hubfs/Campaigns/Apple_Watch/Smartwatch_images-1a.png?width=750&name=Smartwatch_images-1a.png)

But what about the owners of the more bona fide app-intensive smartwatches—smartwatches with the ability to receive texts, display weather and news, play music, and so on? What do they like best? One smartwatch capability most distinguished itself in the study: the ability to screen calls and/or texts via the smartwatch. Respondents described this benefit as a matter of convenience. In the words of a 28-year-old female from Gainesville, Florida: “The best part [of owning a smartwatch] is not having to take my phone out of my pocket to read text messages and emails.”

Respondents widely appreciated how the smartwatch reduces—though it cannot eliminate—one’s dependence on a smartphone. A 45-year-old man from Palm Springs told us he liked “the convenience of not having to fumble for my phone every time I need to communicate.” For these reasons and others, respondents expressed relatively high satisfaction levels with smartwatches in general as well as their specific smartwatch brands. It’s also clear that smartwatch ownership carries some unique and important benefits.

2. Most are loyal to their smartwatch brand…though plenty are also flirting with competitors

Given that respondents reported such high satisfaction levels with their smartwatches, they couldn’t be vulnerable to competing brands…right?

Many in our survey would be first-time smartwatch owners. Consequently, it was uncertain whether their satisfaction was with the general smartwatch category or with their specific smartwatch brand. By way of illustration, even a mediocre movie may seem like an Academy Award winner…if it’s your first movie to watch, and you have nothing to compare it to.

So we sought clarification, to understand where respondents’ loyalties actually reside. We asked point blank: “What is the likelihood you will purchase another smartwatch by this brand?” Combined, more than half said they were either “completely” (36%) or “very” likely (29%) to purchase another watch from their current brand. A strong number. Yet this still leaves 36% particularly vulnerable to other brands—and their aggressive marketing tactics.

3. Smartwatches are well-liked but may lack the momentum to become a pervasive, long-running, “must have” item

Just how important are smartwatches to their owners? Are we talking something on the same level as, say, a smartphone? Or are smartwatches significantly more expendable? To determine the answers to such questions, we asked respondents to tell us what they’d be willing to give up in order to keep their smartwatches. That is, if forced to choose, what sacrifices would they be willing to make to remain smartwatch owners?

We presented users with six different items, and, then, after ensuring the relevancy of each item to respondents, we asked: “Which of the following items would you be willing to give up to keep owning a smartwatch?” The six items were a favorite pair of shoes, a favorite TV show, coffee, Facebook, ice cream, and Netflix. To clarify, only people who actually use or have these items (e.g., coffee-drinkers, Netflix subscribers) were permitted to answer this question.

Some 65% said they’d be willing to part ways with ice cream to keep their smartwatches—making ice cream the most vulnerable item on the list. But as the table below suggests, respondents weren’t as quick to say “goodbye” to other possessions:

![Are you willing to give this up to keep your smartwatch? [CHART] Are you willing to give this up to keep your smartwatch? [CHART]](http://blog.fieldagent.net/hs-fs/hubfs/Campaigns/Apple_Watch/Smartwatch_images-3.png?width=750&name=Smartwatch_images-3.png)

The results are neither overwhelming nor insignificant. They demonstrate that while smartwatches are important to many people, they have not yet achieved the invulnerability of Facebook, Netflix, favorite TV shows, or even a favorite pair of shoes.

Wishing Away Smartphones?

Smartwatches are dependent on smartphones. To work, a smartwatch must by synced with—you might say tethered to—a smartphone. So we wondered, “Are users hoping their smartwatches eventually replace smartphones? Do they like them that much?”

We asked, “To what extent do you agree with this statement: ‘I hope smartwatches eventually replace smartphones’?” Responses were somewhat tepid. In fact, the top two responses were “slightly disagree” (25%) and “slightly agree” (22%). In other words, the majority of respondents essentially said, “I don’t have a strong opinion on this matter.” Only 13% said they strongly agree, while just 10% said they strongly disagree.

Altogether, regardless of intensity level, 56% disagreed and 44% agreed they are ultimately rooting for smartwatches to usurp smartphones. And since exactly half of those agreeing with the statement said they only “slightly” agree, it seems smartwatches are not ready to eclipse the smartphone anytime soon.

Overall, we’re not convinced by the results of this study that smartwatches are poised to dominate the personal electronic landscape on the level of MP3 players and smartphones. Not yet anyway.

4. Owners say: Smartwatches have room for improvement

We gave smartwatch owners an open forum to air their disappointments and/or grievances with smartwatches, if any exist. The vast majority took occasion to cite at least one criticism of their smartwatches.

What frustration was cited most often by owners? Battery life. Many commented on how frequently their devices need to be recharged. Others expressed how they felt the Bluetooth connection between the smartphone and smartwatch drained the latter of its battery life. “The greatest disappointment with smartwatches to date is battery life,” said a 29-year-old female from Menomonie, Wisconsin. “At the end of the day, or if I'm on a trip, I can feel anxious that my watch will die.”

Or as this 61-year-old man from Manchester Township, New Jersey said: “Battery life is short compared to a regular watch.” This is an interesting comment; it raises the possibility some consumers will compare the battery life of their smartwatch—and other features perhaps—not primarily to smartphones but to wristwatches.

In addition to battery life, many respondents complained about the limited capabilities of smartwatches as they presently exist. Here are two representative quotes:

Such comments suggest consumers have fairly high expectations for smartwatches—and it will be interesting to see how quickly manufacturers develop new technologies and add features to the smartwatch as we currently know it.

Additionally, respondents spoke frequently about the limited screen/interface size (small “keyboard” on one end; bulkiness on the other) and stylistic qualities of their smartwatches. They also complained, unsurprisingly, about the smartwatch’s dependency on a smartphone. For instance, several noted how their smartwatch regularly fails to sync (to a smartphone), takes too long to sync, or, otherwise, loses the sync connection too easily.

All of this suggests there are opportunities for smartwatches to improve…or for up and coming brands to establish themselves as dominant players in this young industry.

5. The Apple Watch has its work cut out for it

Yes, there is no small amount of fanfare surrounding the release of the new Apple Watch. And since we were talking with smartwatch owners about their current brands, we also took occasion to ask them about the Apple Watch—specifically, whether they’re interested?

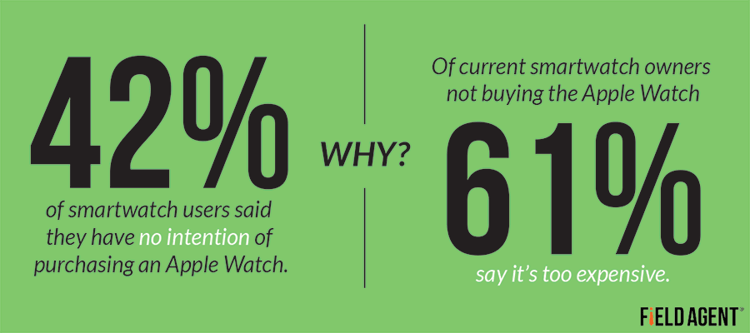

Of the approximately 300 surveyed, only 16% showed strong purchase intentions toward the Apple Watch. Here we define “strong” as those who have either pre-ordered the watch or plan to purchase/pre-order the watch within the next 6 months. But then another 43% acknowledged they would perhaps purchase the Apple Watch in the future, but simply have no definite plans to do so. Lastly, 42% said no thanks altogether, reporting they will never purchase Apple’s latest innovation.

Keep in mind: This survey was not of the general population. The sample included only those who presently own smartwatches, as verified by two photos submitted by respondents and authenticated by the Field Agent quality control team. Furthermore, current Apple customers were well-represented in the sample. Altogether, 77% said they currently own an iPhone or have owned one in the past. 66% and 65% could say the same thing about iPads and iPods, respectively. In fact, only 32 respondents out of 301 said they have never owned an iPhone, iPod, iPad, or other recent Apple product. Consequently, these are consumers that Apple wants—perhaps even expects—to reach with their new watch.

One of the more pressing questions, then, would be: Among the 42% of smartwatch users who said they have no intention of purchasing an Apple Watch…why not exactly? First and foremost, 61% of current smartwatch owners said the Apple Watch is simply too expensive. As a Millennial from Euless, Texas plainly stated, “It's too expensive for what it is.”

Secondly, many said they are content with their present brand of smartwatch, that there’s really no need to switch. In fact, 59% of respondents said they won’t buy the Apple Watch because they’re “satisfied” with their current brand. “I am happy with the watch I currently own,” said a 34-year-old female from Poplar Grove, Illinois. An additional 47% said one reason they won’t buy the Apple Watch is because they don’t own—nor do they want to own—an iPhone, while 27% admitted they just don’t care for Apple products.

You Can Set Your Watch by It

Mobile market research is a reliable, fast, inexpensive means of collecting the business information and consumer data that, to quote Jim Collins, “drive your economic engine.” Whether you’re in need of in-store audits or consumer research, our team of research professionals, along with our panel of over 500,000 agents, is standing by to serve your company, or click here to learn how to you can start your own projects yourself. Learn more about mobile market research, and subscribe to our blog to stay in the know with our free special reports.