If you’re an established brand, the headlines may feel pretty ominous these days.

As of today, a quick Google search of “Millennials and Brands” turns up the following first-page results:

- “As Millennials Demand More Meaning, Older Brands are Not Aging Well”

- “The Millennial Dilemma: Generic Generation Doesn’t Want You”

- “Here’s Why Millennials are Ignoring Your Brand”

Such dire headlines suggest Millennials are in a branding-and-marketing class all their own: less brand loyal, more prone to switch brands, and more open to private labels.

But a recent Field Agent survey could suggest differently.

Download the free special report: “Brand New World: Exploring the Critical Issues Facing Today’s Brands”

5 Insights into Millennials & Their Brand Purchases

Last night, retail-auditing and insights firm Field Agent surveyed 1,959 shoppers*—905 Millennials and 1,054 Non-Millennials—about their attitudes and shopping habits toward brands, specifically in the packaged grocery and household consumable** categories. Our aim was to illuminate, potentially, the similarities and/or differences between Millennials (ages 18-35) and Non-Millennials (36+).

*All respondents were U.S. adults at least 18 years of age who own smartphones. The survey was administered through the Field Agent mobile app. **"Household consumables" include any non-grocery, non-durable goods like cleaning supplies, detergent, toilet paper/paper towels, pet supplies, baby supplies, personal care items, OTC medications, air fresheners, etc.

Below we distill 5 insights from the survey:

1. Like Non-Millennials, Millennials are split over brand loyalty

Are shoppers today looking for a committed relationship with a single brand (among packaged groceries and household consumables), or do they prefer to, you know, date around?

On the whole, 58% in our survey said they “prefer to find a single brand to buy consistently over time,” while 42%, conversely, “prefer to switch back and forth between brands.”

The small majority, then, wants a loyal relationship with one brand.

But what’s most striking is this: Broken down by generational category, the results are remarkably similar for Millennials and Non-Mills. Fifty-six percent of Millennials, compared to 59% of Non-Millennials, prefer staying true to one brand over time as opposed to shopping around.

2. Compared to Non-Mills, Millennials show similar levels of brand loyalty to single brands in specific product categories

Of course, when it comes to discussions about brand loyalty, no two product categories are created the same. So Field Agent assembled a theoretical basket of six common “grocery store” goods and asked shoppers to rate how loyal they are to a single brand in each category.

As you can tell from the graph below, in practically each category, Millennials and Non-Mills are more alike than different.

3. Millennials demonstrate similar levels of brand-switching as well

For the same basket of goods, we also asked respondents to identify the categories in which they have switched from one primary brand to another primary brand over the past three years.

In only one category, toilet paper, did more than half of shoppers—in this case all Millennials—say they’ve switched primary brands over the past three years.

Yet, once again, it’s the similarities between Millennials and Non-Millennials that constitute the real storyline.

Consider the results. Here are the percentages of those who have switched primary brands within the last three years, by category:

- Toilet Paper - Millennials: 53%; Non-Millennials: 47%

- Toothpaste - M: 47%; NM: 42%

- Potato Chips - M: 42%; NM: 47%

- Beer - M: 33%; NM: 29%

- Ketchup - M: 29%; NM: 28%

- Tuna Fish - M: 22%; NM: 24%

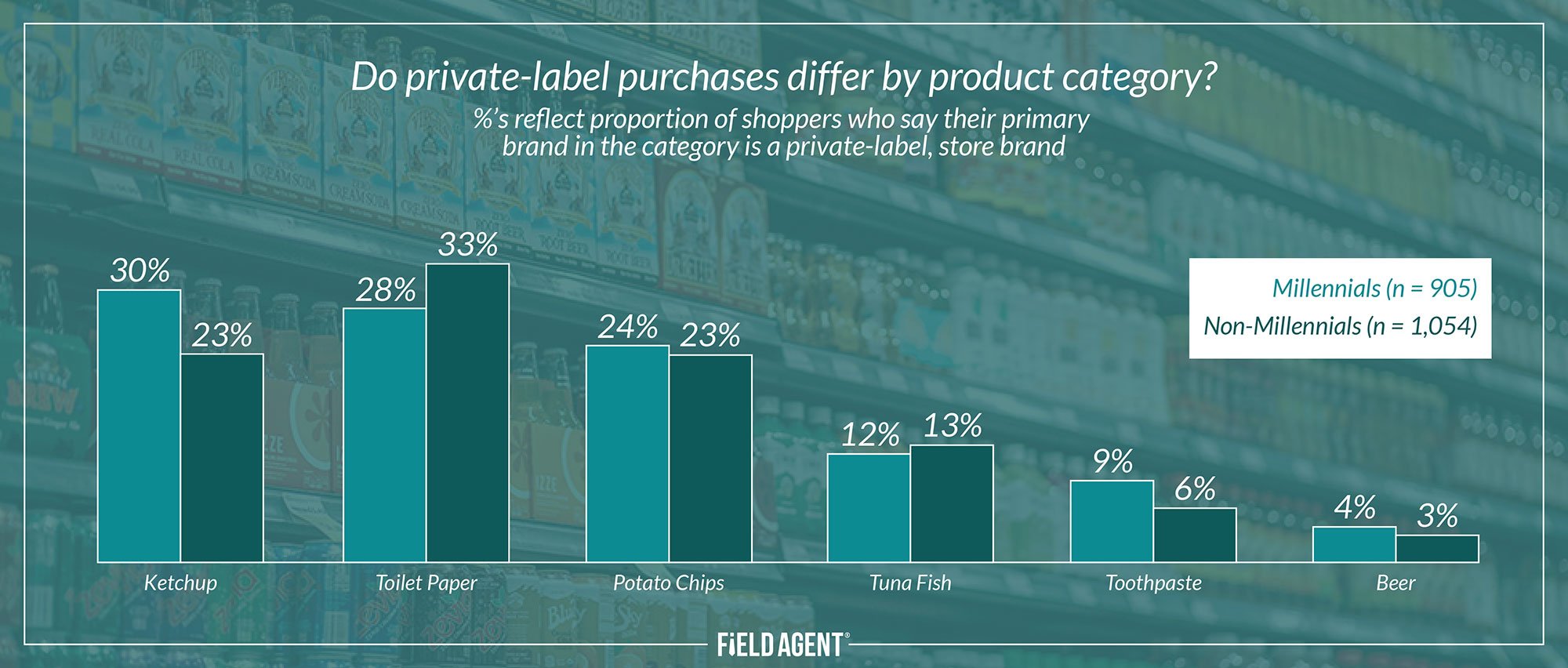

4. Preferences for private labels do not look starkly different between Mills and Non-Mills

Field Agent presented the same basket of goods yet again, this time asking, “In which of these categories, if any, is your primary brand a private-label, store brand?”

As the graph shows, although there are meaningful differences between product categories, the differences between Millennials and Non-Millennials are comparatively negligible.

5. Millennials are extremely loyal to practically the same brands as Non-Mills

Even when you question shoppers about their favorite brand names...Millennials and Non-Millennials come out looking markedly similar.

Field Agent asked respondents to "identify one brand to which you're extremely loyal," across three different categories. This was a free form question, meaning no choice options were imposed on respondents.

Significantly, Mills and Non-Mills identified many of the same brands, and their top three brands per category are almost identical, as you can see in the infographic.

It's important to note: Millennials, like Non-Millennials, primarily cited established, conventional name brands—the Crests, Cokes, and Krafts of the world—as those to which they're most loyal.

In Summary: More Similarities than Differences

It appears there may be more differences among Millennials than between Millennials and Non-Millennials, suggests Field Agent’s survey of almost 2,000 shoppers. Instead of finding weaker brand loyalty among Millennials, this mobile survey implies our assumptions about this important class of shopper may not be entirely accurate.

Want More Insight on Brands?

Based on surveys with thousands of shoppers, Brand New World: Exploring the Critical Issues Facing Today's Brands, takes an intense, data-driven look at the contemporary branding landscape.

This free report examines shoppers' attitudes toward:

- Private labels versus name brands

- Online private label brands

- "Off-brander" retail operations like Aldi and Lidl

- Brand loyalty and brand-switching

Download this free report today…and start exploring the “brand new world” around us!