Scaring Up Sales: How CPG Brands Can Make the Most of Halloween

"Halloween is our Super Bowl."

That's how one CPG professional from a leading candy company described the upcoming holiday.

"It's what we as candy brands are most closely associated with," she said. "Unlike Valentines and Christmas, Halloween is directly affiliated with candy...it's a much larger audience."

For candy brands and other CPG companies, this Halloween in particular carries an unusual amount of weight. The holiday was a subdued affair in 2020, as shoppers wrestled with something far scarier than ghouls and goblins: the COVID-19 pandemic.

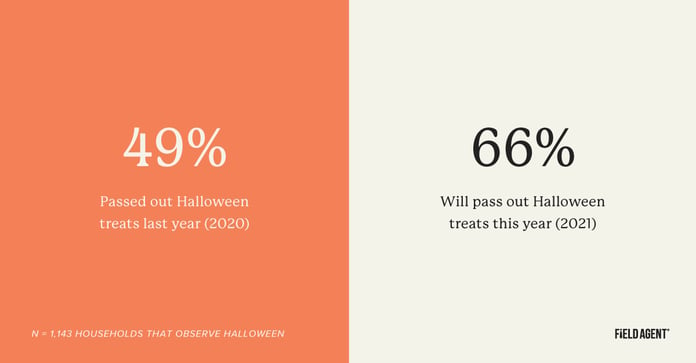

A recent survey of over 1,100 households, conducted for Field Agent's CPG Guidebook for Q4 Success, found that only 49% passed out Halloween candy in any form last year.

But times change, and for various reasons, many households may feel more comfortable participating in the holiday in 2021. The same survey found that 66% of households plan to distribute treats this year: an increase of 17 percentage points.

Additionally, 43% of Halloween households (n = 857 surveyed shoppers who expect to make Halloween purchases this year) said they plan to spend more on the holiday than they did last year, compared with just 19% who expect to spend less.

That increase is welcome news to many brands.

So what can CPG companies, particularly brands that rely heavily on a strong Halloween showing, do to scare up more Halloween sales this year?

Let's consider some tricks, er, tips.

How to Win More Halloween Sales

The CPG Guidebook for Q4 Success, a free resource from Field Agent, is full of advice from a panel of CPG veterans.

Let's consider just two tips from the guidebook that are especially relevant in the Halloween season, along with some additional commentary from our candy insider.

Tip #1: Win the Space Wars

The guidebook presents a tried-and-true formula for retail success: inventory + space + execution = Q4 success. Clearly, space is key to Q4 sales.

Growing your brand's in-store footprint (and using it effectively) is a fundamental way to increase sales - especially in a short, high-volume season like Halloween.

"The name of the game is proximity," states the guidebook, "being proximal to as many purchase-minded shoppers as possible."

Our candy insider agrees.

"Many companies will have their retail team be the 'front men' for their seasonal game plan," she said. "They have their retail team game-planning with store managers in July to properly allocate floor space in order to achieve higher sell-through. This allows the floor to turn over candy quicker to get the upcoming pallet into the place of the previous one."

Ultimately, the more space you command, the more sales you'll generate.

Of course, easier said than done, especially for smaller brands. The guidebook contains specific advice and tools for "winning the space wars."

Tip #2: Hit the Sales Floor Early

If you've heard it once, you've heard it a thousand times: the early bird gets the worm.

Nowhere is this more true than in seasonal retail.

After all, to get the most out of your Q4 sales, your SKUs not only need to be where shoppers are, they need to be when shoppers are.

And Halloween is no exception.

"The Halloween season starts subtly in July," said our candy insider. "Many companies start the season early in order to achieve the fullest sales potential. We'll start sending out impulse candy and other smaller-ticket items to get our consumers thinking about the transition from summer to fall."

This is the kind of strategic thinking that is rewarded when the big day comes around.

A little creativity (and a lot of preparation) gets real results for candy companies and other brands that rely on Halloween sales.

Don't Be Spooked by Q4. Be Prepared.

Q4 is much more than Halloween. Gameday, Thanksgiving, Christmas, and other shopping events make it a crucial three-month span for many brands. That's why Field Agent created “The CPG Guidebook for Q4 Success” - to help your brand make the most of Q4 2021.

This free guidebook contains:

- Expert advice from seven veteran CPG professionals

- Insights into shoppers' attitudes and intentions from surveys with over 2,000 shoppers

- Useful tools to help your brand win more sales in the final months of the year

Download your free copy below.