Rapid Response: 1,000 U.K. Shoppers Talk Asda-Sainsbury’s Merger

Call it a royal wedding. Sainsbury’s and Walmart’s Asda are headed for the altar.

News of the union, which proposes to marry two of the United Kingdom’s largest merchandisers, made immediate waves this weekend—waves felt clear across the Atlantic, with major implications for Walmart’s strategic trajectory.

By bringing together the market’s #2 and #3 grocers, the U.K. now has a new “biggest” retailer, and all it took was $10 billion in cash and stock options.

All of this to say, Asda-Sainsbury’s is a big deal. One that’ll consolidate 2,800 stores under the same spacious roof.

But what, it remains to be seen, do Asda and Sainsbury's shoppers think about the merger, which now only needs to clear regulatory obstacles?

That is the question.

Rapid Response: Asda & Sainsbury's Shoppers Share Attitudes toward Merger

This morning, Field Agent, with operations in the United Kingdom and seven other countries, ran a "rapid response" mobile survey. By noon, 1,114 U.K. shoppers had given us their feedback. The sample included 700 Asda and 700 Sainsbury's shoppers. This study was conducted with global consulting firm Accenture.

Most of all, we wanted to know how shoppers expect the merger to influence their shopping routines.

Below we offer a five-question Quick-Fire Q&A with U.K. shoppers about the Asda-Sainsbury's merger.

Quick-Fire Q&A with Asda & Sainsbury's Shoppers

1. Are Asda-Sainsbury's shoppers even aware of the merger?

Absolutely. In Field Agent's survey, 9-in-10 U.K. shoppers said they were aware of the news.

2. Do shoppers expect the merger to be good or bad for shoppers, ultimately?

Shoppers in the United Kingdom are torn. Some 44% believe the merger will be mostly positive for British shoppers, while 31% predict it will be mostly negative.

3. How will the merger influence the shopping levels of Asda-Sainsbury's patrons?

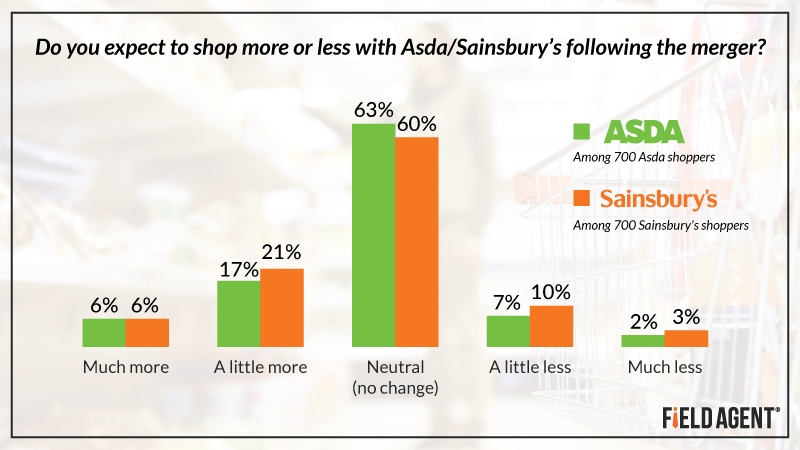

As the graph clearly shows, the majority of Asda and Sainsbury's shoppers don't expect the corporate marriage to influence their shopping levels one way or the other.

Among Asda shoppers surveyed, however, 23% say they expect to increase their shopping with Asda in the wake of the merger, while 9% think they'll rein in their shopping with the retailer.

Of Sainsbury's shoppers, 27% think they'll shop with the retailer even more following the merger, compared to 13% who think they'll shop less at Sainsbury's.

4. In what ways do Asda shoppers expect the merger to influence the retailer?

We asked Asda shoppers what, if anything, they expect will change at Asda following the merger.

On a positive note, 51% anticipate a wider range of products on the shelves. Some Asda shoppers also expect positive changes to the quality of its produce (37%) and its online-shopping capabilities (34%), which overall will lead to Asda having a better brand reputation according to nearly half the Asda shoppers (48%).

Negatively, however, 25% think the merger will adversely influence prices overall and even more (34%) expect a negative impact on price promotions at Asda.

5. And how do Sainsbury's shoppers expect the merger to affect that retailer?

Once again, in a positive sense mainly.

More than half, 52%, of Sainsbury's shoppers believe the merger will result in lower prices offered by the retailer. Likewise, 45% expect better price promotions from now on.

Sainsbury's shoppers also sense positive implications for the range of products carried (41%) as well as the retailer's online-shopping capabilities (26%).

Some 26%, on the other hand, expect the merger to negatively affect Sainsbury's brand reputation, and 16% are concerned about the quality of its produce.

Wrapping Up: Asda-Sainsbury's Merger

Following the merger, the results from this survey suggest:

-

For both retailers, shoppers who expect to increase their shopping (at least a little) with their existing retailer[s] of choice outnumber those who expect to decrease their shopping

- The majority of shoppers believe Sainsbury's prices and Asda's product selection will improve

In conclusion, we invited shoppers to send messages to the CEOs of Asda and Sainsbury's. Although the statements below are direct quotes from single respondents, they were selected on the merits of their representativeness of the sample as a whole:

To Sainsbury's CEO:

"Prices should remain competitive, but farmers and suppliers should be given a fair deal."

To Asda CEO:

"My message would be, to stay true to your brand. It is recognised as affordable quality, don't increase prices. Rather, create space for Sainsbury's to retain a quality brand at more affordable prices."

Now Available! The Digital Shopper [Special Report]

Based on studies with thousands of shoppers across six countries, Field Agent’s special report, “The Digital Shopper: Insights into Today’s Most ‘Connected’ Customers,” offers companies an inside, shopper-centered look at online retail. Special features include:

- The digital shopper’s journey: before, during, and after shopping for groceries online

- Shoppers try and rate Instacart delivery

- The product detail page: a shopper-guided tour

- Shoppers compare PDPs on Walmart.com VS Amazon.com

- Shoppers try and rate Amazon Lockers at Whole Foods Market

Best of all, the report is free.