![]() These days, some department stores may feel like they’re trying to walk up the down escalator. The news has been pretty gloomy: declining sales, store closures, and whatnot.

These days, some department stores may feel like they’re trying to walk up the down escalator. The news has been pretty gloomy: declining sales, store closures, and whatnot.

Earlier this month, Macy’s announced it would close 100 stores, and, for the most recent quarter, Macy’s, Kohl’s, and Nordstrom all reported waning revenue.

To add insult to injury, some brands are rethinking their distribution strategies vis-à-vis department stores. Coach, the upscale maker of handbags and accessories, recently said it would remove its products from some 250 department stores, concerned over the effect of deep discounting—an increasingly prevalent tactic among department stores—on the brand’s luxury image.

What Do Female Shoppers Think about Department Stores, Their Future?

Given all the news, Field Agent, recently named Mobile Research Agency of the Year by MRMW, set out to understand the shopping behavior of women, especially as it informs considerations about the longevity of department stores.

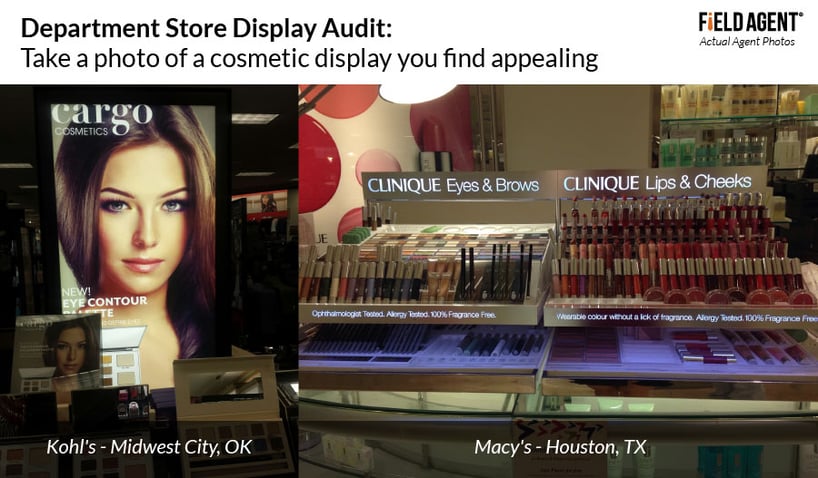

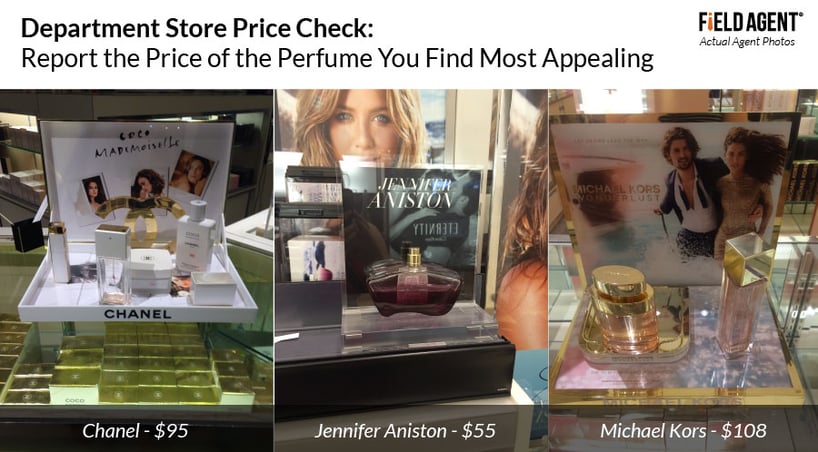

Moreover, as the images and video below demonstrate, we also sent female shoppers to three department stores—Kohl’s, Dillard’s, and Macy’s—to conduct display and pricing audits. For this, the audit portion of the study, all participants were Millennials between the ages of 25-34.

Below we present highlights from this study as a 7-question Q&A.

7 Questions with Women: Department Stores

1. How do department stores stack up against other retail channels for women’s clothing and cosmetic purchases?

As the charts display, department stores placed fourth among female shoppers for regular cosmetic purchases and third for regular clothing purchases. In both product categories, department stores fared better than online-only retailers, yet it's apparent that special beauty retailers like Ulta and off-price retailers like T.J. Maxx have disrupted the department store channel.

Altogether, the survey suggests department stores still hold a prominent place among women for regular clothing and cosmetic purchases. It should be noted, however, that department stores performed less strongly with the 25-34 age bracket. Among Millennials, 49% reported regularly buying clothing from department stores (compared to 57% for those 35+), while 27% said they patronize department stores for cosmetics (32% for 35+).

![Field Agent - Where do women regularly shop for cosmetics and clothing? [GRAPH] Field Agent - Where do women regularly shop for cosmetics and clothing? [GRAPH]](http://blog.fieldagent.net/hs-fs/hubfs/Campaigns/Department_Stores/Department-stores-where.jpg?width=818&name=Department-stores-where.jpg)

2. Are women shopping more, less, or about the same with department stores today?

For this question, Field Agent asked women to consider how much they’re shopping with department stores today compared to five years ago—more, less, or about the same.

For this question, Field Agent asked women to consider how much they’re shopping with department stores today compared to five years ago—more, less, or about the same.

Almost half (47%) said they’re shopping with department stores less to one degree or another. (23% indicated only a little less.) For this question there were no notable differences between 25-34 year olds and the 35+ age range.

Conversely, 25% reported shopping more these days with department stores, and 29% said they’re shopping about the same as five years ago.

3. Why are some women shopping less with department stores?

Of those shopping with department stores less (n = 287), Field Agent followed up with a close-ended, multiple-choice question, “Why specifically are you shopping less with department stores today?”

Just over half (51%) said the prices at department stores are too high, and, similarly, 48% admitted they personally have less money to spend these days. Notably, an additional 41% reported doing more of their shopping online today—the third most common response.

4. What typical department store goods are women most frequently buying online?

![Field Agent - What typical department store goods are women most frequently buying online? [GRAPH] Field Agent - What typical department store goods are women most frequently buying online? [GRAPH]](http://blog.fieldagent.net/hs-fs/hubfs/Campaigns/Department_Stores/Department-stores-online.jpg?width=400&name=Department-stores-online.jpg) If more than 4-in-10 women cite online shopping as a reason for spending fewer dollars with department stores, what traditional department store goods are they actually buying online?

If more than 4-in-10 women cite online shopping as a reason for spending fewer dollars with department stores, what traditional department store goods are they actually buying online?

Casual wear (44%), home décor (44%), footwear (42%), fitness wear (30%), and home furnishings (30%) topped the list of products women are buying more of online today, compared to five years ago.

5. What role do department stores play in women's overall shopping program?

To answer this question, Field Agent asked more than 600 women when—that is, on what occasions and for what reasons—they shop department stores.

Interestingly, at the very top, 43% responded “When I’m shopping for other people,” as in gift-buying or shopping for a spouse/child.

This was followed by:

- When I’m looking for particular brand names – 42%

- When it’s particularly important I look my best – 40%

- When I want to shop a large variety/assortment – 38%

- When I’m looking for high quality products – 31%

- When I’m shopping with friends – 31%

Clearly, department stores still have a particular niche hewed out in the minds of many female shoppers.

See also: A Cosmetics Primer: 500 Women Talk Makeup Shopping, Usage [Survey]

6. Are women still emotionally connected to department stores?

What would happen, Field Agent asked, if department stores disappeared? If they altogether ceased to exist?

Respondents were instructed to answer this question only as shoppers, and not to consider the larger economic and social ramifications.

More than half (55%) said they’d be either extremely or very regretful, and another 36% reported they’d be moderately regretful. Only 5% responded not at all regretful.

Most women, it seems, want department stores on the shopping landscape.

7. What can department stores do to reverse the trend of declining sales and shopper traffic?

Field Agent put this question to women, this time as a free form, open-ended query.

Overwhelmingly, respondents cited lower prices and better/more frequent promotions. As one 35-year-old woman remarked, “They need to become more competitive with pricing and sales.”

Regardless of the specific recommendation—lower prices, loyalty programs, larger selections, or better digital services—the results on the whole suggest women simply want more incentive to shop department stores, that is, a distinct value proposition that would reward them for leaving the house and shopping in stores.

Regardless of the specific recommendation—lower prices, loyalty programs, larger selections, or better digital services—the results on the whole suggest women simply want more incentive to shop department stores, that is, a distinct value proposition that would reward them for leaving the house and shopping in stores.

Or, like one 26-year-old woman said, “Provide a unique experience that shoppers won't find anywhere else...”

Conclusion: It's A Mixed Bag for Department Stores

The results are a mixed bag for department stores and their future, full of both bad and good news.

The bad news? Indications from this survey suggest online shopping and off-price/specialty retailers have, indeed, disrupted the department store channel, creating a new and daunting competitive environment.

The good news?

Department stores:

- Remain an important destination for women purchasing clothing and cosmetics

- Hold established positions in the minds of female shoppers, some of which would be difficult to copy (e.g., a destination for looking one’s best)

- Enjoy a moderate-to-strong emotional connection with women who say they’d regret a world without department stores

Even more good news?

Whether you’re a department store, a brand that sells through department stores, or a company in an altogether different industry, Mobile Research and Audits offer a fast, affordable, and convenient means for understanding shoppers and increasing retail sales. Download the infographic, “Bridging the Knowledge Gap,” to learn more.