How Bad is the Supply Chain Crisis, Really? A Nationwide Audit

Long a critical business function, the term "supply chain" has finally entered the cultural mainstream.

Everybody’s talking about it. My mom is talking about it!

"Chris, with the supply chain like it is nowadays, don’t wait until the last minute to buy your Christmas gifts this year." Thanks, mom.

But with everybody from G20 leaders to my dear mother talking about stock shortages, it’s time we stopped and asked…

How bad is this supply chain crisis in terms of actual stock levels in stores?

How “short” are stock shortages, really?

Auditing & Surveying the Supply Chain Crisis

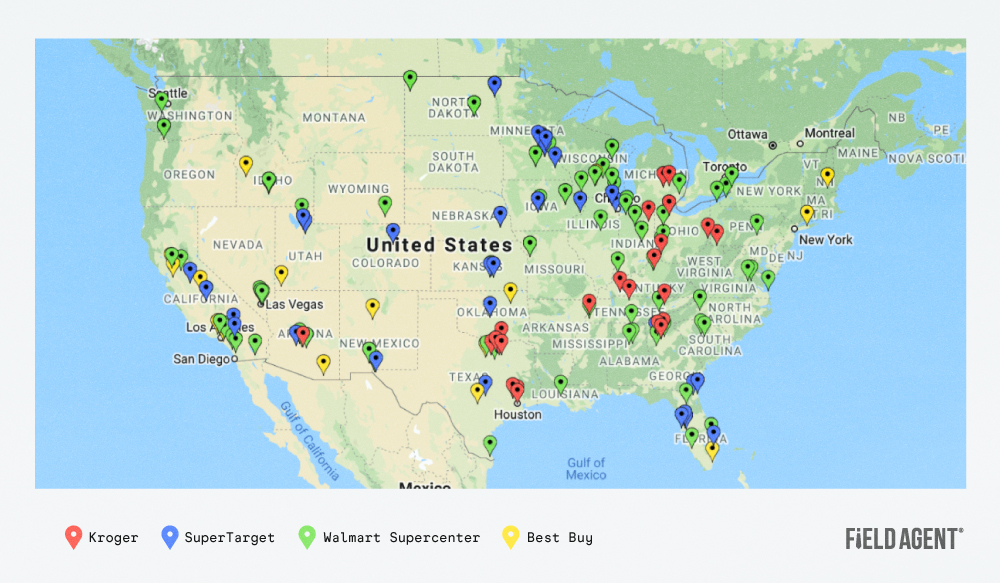

On November 4, 2021, Field Agent audited 13 categories across 203 stores (1,316 total aisles) operated by four different brick-and-mortar retailers: Best Buy, Kroger, Target, and Walmart.

Our objective: to look generally at in-store stock levels across a diversified basket of goods, including groceries, household consumables, electronics, and toys.

The results give us an idea about the size and scope of supply chain disruptions, as they're being felt by shoppers at the store level.

Of course, retailers, brands, and shoppers aren’t just dealing with the reality of stock shortages; they’re also dealing with the perception of them.

So how bad is the supply chain crisis in shoppers’ minds, and how are they responding to them? To get at that story, Field Agent also surveyed 1,245 U.S. shoppers* about supply chain shortages—their perceptions as well as their reactions.

Let’s dig in to the combined audit and survey results.

**All survey respondents were U.S. adults at least 18 years of age and smartphone owners. The survey was executed through the Field Agent platform, November 5, 2021. Demos: Gender - Female (51%), Male (49%), Age - 18-24 (8%), 25-34 (31%), 35-44 (35%), 45-54 (18%), 55-64 (7%), 65+ (2%); Household Income - < $35K (23%), $35-49K (15%), $50-74K (20%), $75-99K (14%), $100K+ (17%). We weighted data to more accurately reflect the U.S. racial profile: Caucasian (63%), Latino/Hispanic (17%), African American (14%), Other (6%).

So How Bad is the Supply Chain Crisis? No, Really

Short answer: it depends.

It depends on geographic location, retailer, category, and so on. In other words, it’s relative.

Matt Fifer, a former Walmart marketing executive turned serial entrepreneur, has been on the road visiting stores across the country lately. He reports drastically different stock levels depending on where he is in the country, and depending on the local buying patterns.

"I think it goes without saying that there are attitudinal factors that vary among individual shoppers and are more dominant in some communities than others...," Fifer said. These attitudinal factors—for instance, the tendency to stock up for long winters—"impact an individual store's ability to keep categories of merchandise in stock."

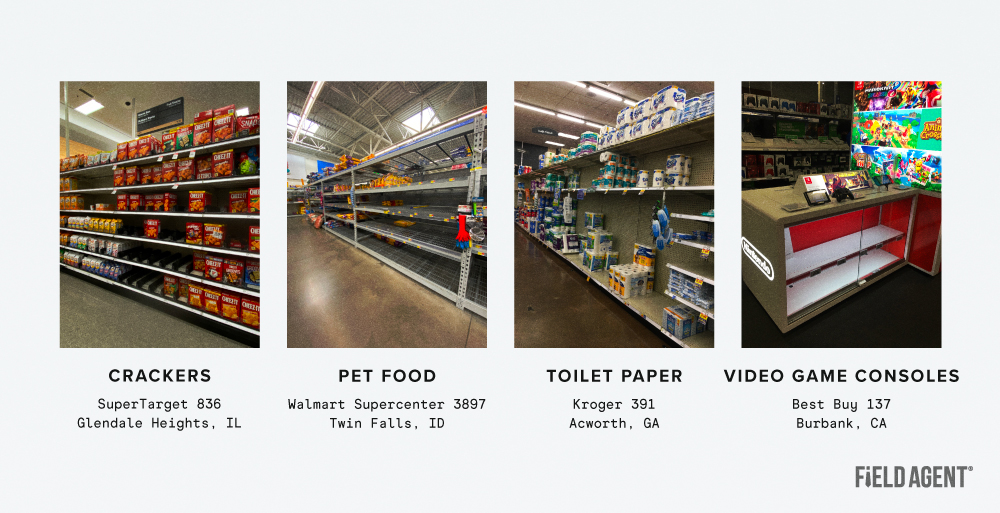

Consequently, some store shelves look pretty darn sparse right now, while other shelves currently look a-okay.

Here’s a look at some of the shabbier shelves from our audit of 203 stores nationwide.

But let’s do better than “it depends.” Let’s get a national snapshot.

We enlisted shoppers, all Field Agent app-users, to conduct Category Overview audits of canned vegetables, bottled juices, crackers, toilet paper, diapers, pet food, laundry detergent, action figures, dolls, soundbars, video game consoles, smart security systems, and smart locks.

For each category in each store, our auditors took a photo and answered the question, “Compared to normal conditions, how would you describe stock levels of the [specific category] aisle in this store?” They could answer much lower, lower, and a little lower as well as normal or higher.

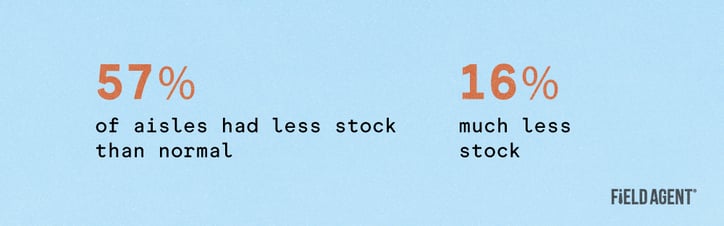

Altogether, 57% of audits (across all 1,316 aisles) found less stock than normal (i.e., the auditor reported that stock on the aisle was much lower, lower, or a little lower than normal).

Sixteen percent of aisles showed much less stock.

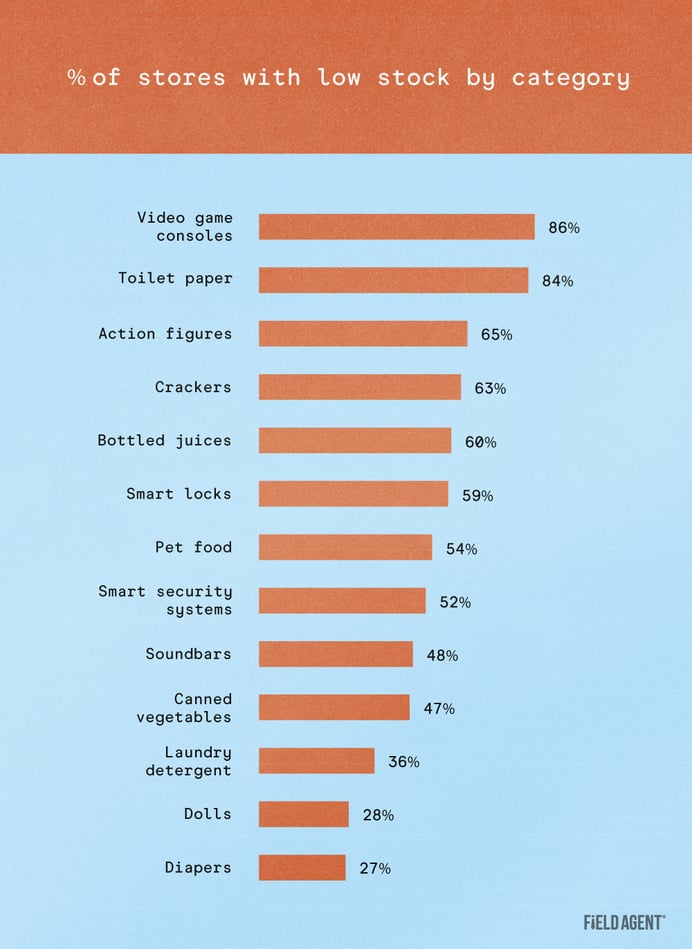

Of 13 categories audited, video game consoles (86%) and toilet paper (84%) were most commonly reported as low in stock, generally.

In some of these cases, however, the stock available was only “a little lower” than usual.

So what about critically low categories?

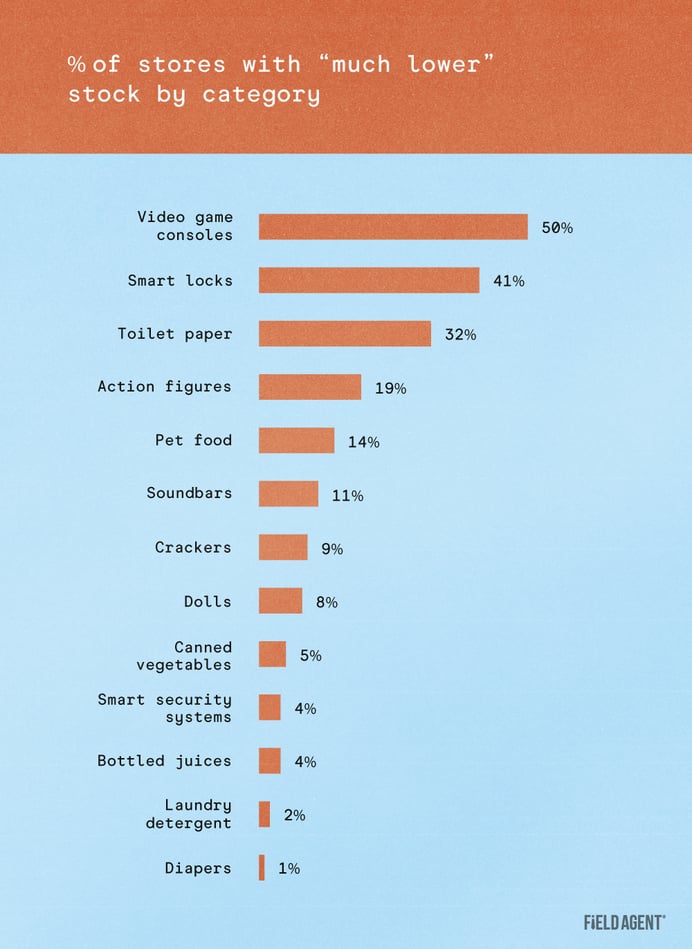

As a dad searching for a Nintendo Switch (Mario Kart bundle) to give his son this Christmas, it comes as no surprise that video game consoles (50%) are out-of-stock in many stores.

And, there appears to be another run on toilet paper. Thirty-two percent of toilet paper aisles were reported as having "much lower" stock levels than normal.

“It seems everything is in stock at similar levels as usual except laundry detergent and toilet paper,” said one shopper in Greenfield, WI. “At just about every store I go in they are low on those two categories.”

Another in Kalamazoo, MI said, “[Stock levels] are about the same but people are still hoarding toilet paper.”

In our audit, electronics, always a popular holiday gift purchase and often sourced from overseas, were more likely to be "much lower" than groceries and household consumables.

And the Survey Says

Notably, the results from the audit align well with the results from our survey of 1,245 shoppers across the U.S.

We asked shoppers (n = 1,122 shoppers who have shopped in-store for groceries/household consumables over the last two months), “Compared to the first half of the year, how have IN-STORE stock levels for groceries/household consumables been over the last two months?”

Fifty-nine percent of respondents, in all, said there has been less inventory for groceries/household consumables recently. Seventeen percent said there has been much less.

Now compare the survey results to the audit results. When audit data are limited to groceries and household consumables only, we found 53% of aisles lower in stock than normal.

What About Online?

The survey posed a similar question to online shoppers—in this case, n = 772 respondents who have shopped online for groceries/household consumables over the last two months.

Of these, 48% reported less product available online than usual, while 17% reported much less.

“The past three online orders that I've made...have had [more] substitutions and/or unavailable items upon pickup,” said a shopper in De Leon Springs, FL. “Prior to completing the order I've also noticed more out of stock items.

“It does get frustrating when I plan meals around the order and then arrive to find so many unavailable groceries.”

Categories Most Commonly Reported as Out-of-Stock

An out-of-stock is a scary prospect for brands, retailers, and shoppers alike. If there’s one thing our research over the years suggests: Shoppers loathe out-of-stocks.

As do the companies that lose the sales.

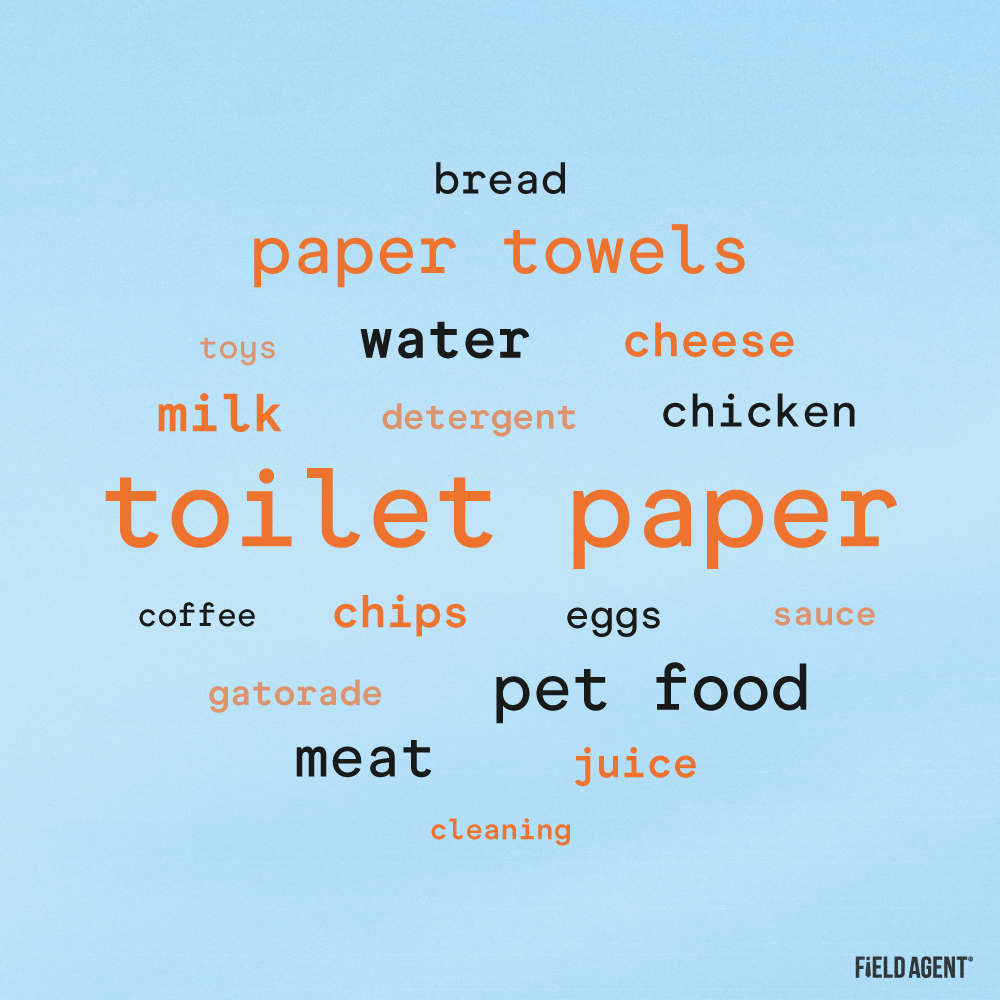

In the survey, we also asked shoppers to list the three categories (free form question) they’ve most commonly found out-of-stock (in-store or online) over the last few months.

We analyzed thousands of free form responses, with the top responses shown in the word cloud. Shoppers reported routinely encountering out-of-stocks with toilet paper, paper towels, and pet food.

How are Shoppers Responding to Lower Stock Levels

Really, this is the question. When shoppers encounter out-of-stocks or skimpy stock levels in stores and/or online, how do they react? What is their go-to response?

In-store first.

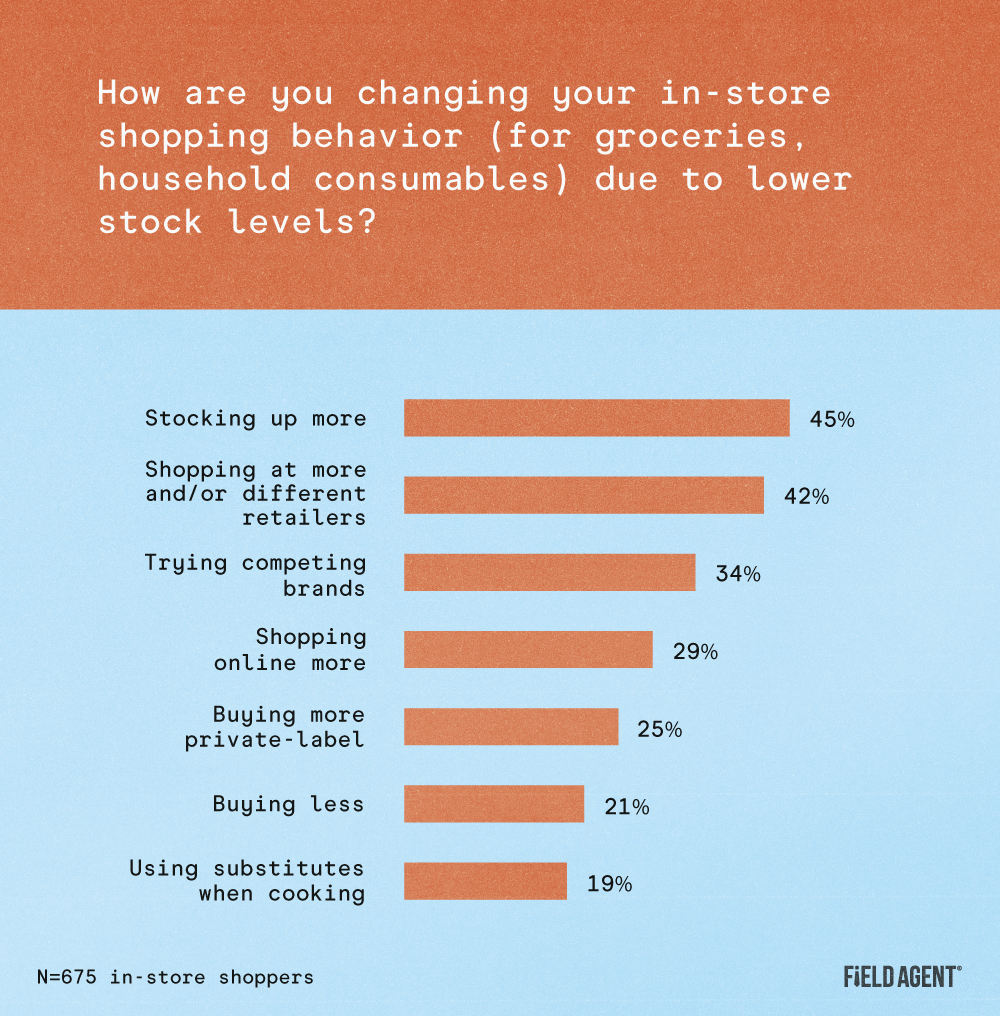

As you can see, of in-store shoppers who said inventory levels for groceries/household consumables in their local stores have been lower than normal (n = 675), right at half said they've reacted by stocking-up.

As one shopper from Phoenix, AZ explained, “These are normal every day items that are usually in stock. It is making me over-shop when items are in stock."

The next two reactions should cause companies across the retail industry—both brands and retailers—to sit up and take notice. Forty-two percent said they're responding to lower stock levels by shopping at more and/or different retailers, whereas 34% said they're trying competing brands.

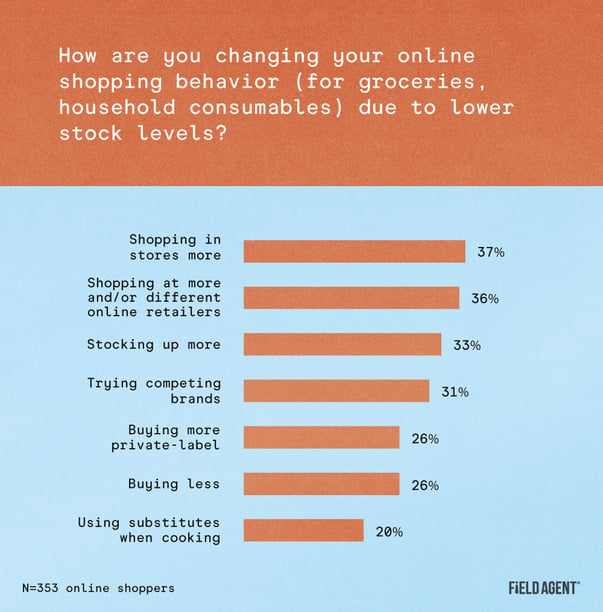

Now, for online. Among 353 shoppers who have made online grocery/household consumable purchases in the last couple of months, and who have noticed less product availability, 37% said they're responding by shopping inside stores more. Here, too, shopping at more/different online retailers and stocking up are common reactions.

What About Shopping for Holiday Groceries?

From news outlets to best friends, everyone's talking about shopping early for holiday gifts this year. Of course, groceries are also important during this festive time of year. So what about them?

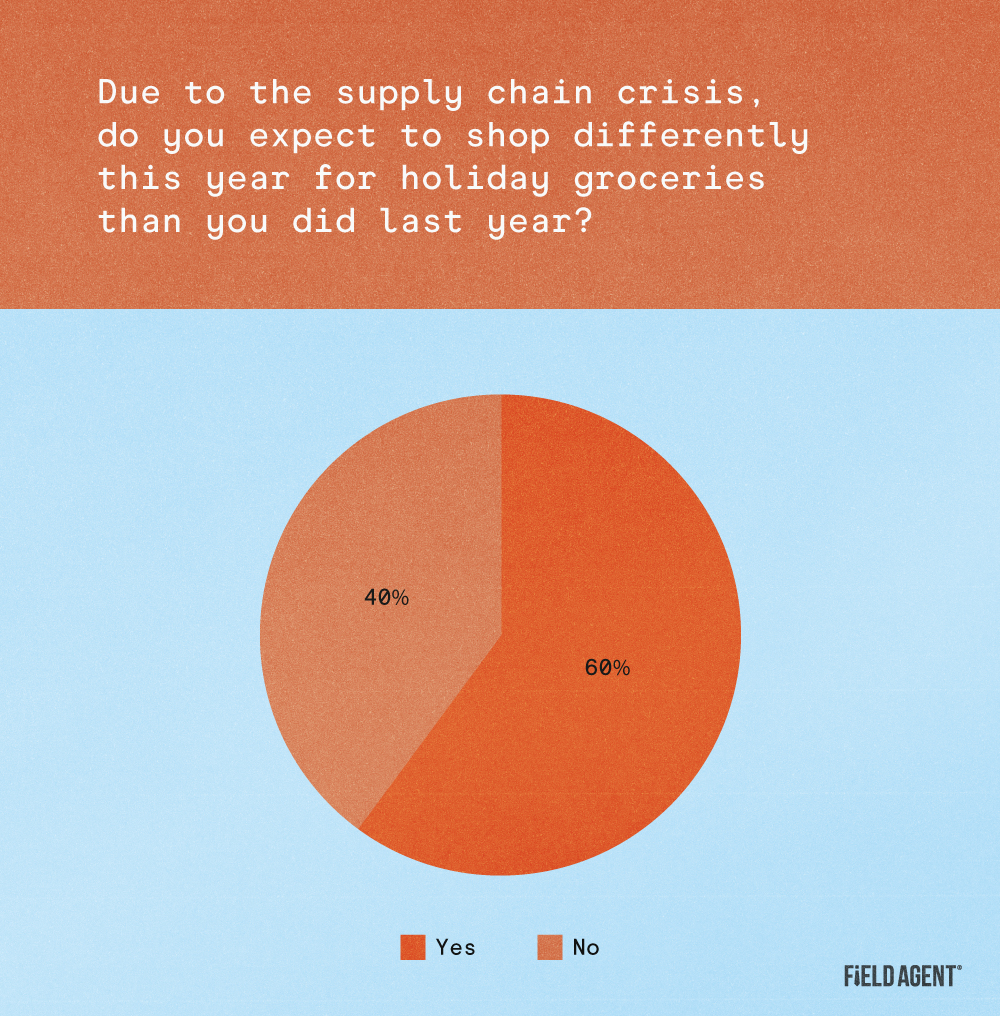

Are shoppers planning to shop differently for holiday groceries due to supply chain strains?

In our survey, three-of-five said they'll approach grocery shopping differently this year.

Of 672 shoppers who will alter their holiday grocery shopping, a whopping 87% said they plan to purchase groceries earlier this season. And then, of course, there's stocking up, which more than half (57%) said they plan to do with holiday grocery purchases.

What a holiday season awaits!

Launch a Category Overview or OSA Audit in Minutes

Need to see store shelves? Like, right now?

The Field Agent Marketplace offers an assortment of fast, affordable, altogether simple auditing solutions designed to give brands and retailers visibility into stores—entirely on-demand. You're never farther than a few clicks away from stores everywhere, whether you need Category Overview Photos, On-Shelf Availability, or another auditing solution.

Click below to launch an OSA audit in minutes.