Inspecting On-Shelf Availability & Out of Stocks at 4 Major Retailers

Too much or too little.

Both are costly predicaments in the balancing act that is on-shelf availability (OSA).

Too much stock on-shelf? The retailer’s working capital is tied up in something that’s doing, well, absolutely nothing. Just collecting dust really.

Too little (or no) stock on-shelf? Here the tragedy for retailers is at least two-fold: missed sales and a tarnished customer experience.

Few things frustrate shoppers more than the dreaded out-of-stock (OOS), particularly today, when shoppers are more time-strapped and convenience-driven than ever.

Download our special report, "Kroger X," to go inside the CX at Kroger

Yes indeed, OSA/OOS is a careful balancing act, with weighty implications for retailers and the brands they sell.

The question is…how are today’s major retailers faring on OSA/OOS?

Let’s take stock.

Taking Stock of Stock Levels

This weekend, Field Agent dispatched agents to 80 stores across four major retail chains (20 stores each): Albertsons/Safeway, Kroger, Super Target, and Walmart.

While inside stores, agents audited the stock-levels of nine different name brand goods:

- Dawn Ultra original dishwashing liquid, 28 oz.

- Pedigree dry, adult dog food, 20.4 lb. bag, "grilled steak and vegetable flavor"

- Reese's peanut butter cups, miniatures, 10.5 oz. bag

- Doritos party size, nacho cheese flavored tortilla chips, 15 oz. bag

- Uncle Ben's long grain and wild rice, original, 6 oz. box

- Hidden Valley Ranch, original flavor, 24 oz. bottle

- Prego Italian sauce, traditional flavor, 24 oz. jar

- King's Hawaiian original Hawaiian sweet rolls, 12 ct. bag

- DiGiorno rising crust, pepperoni, frozen pizza, 27.5 oz.

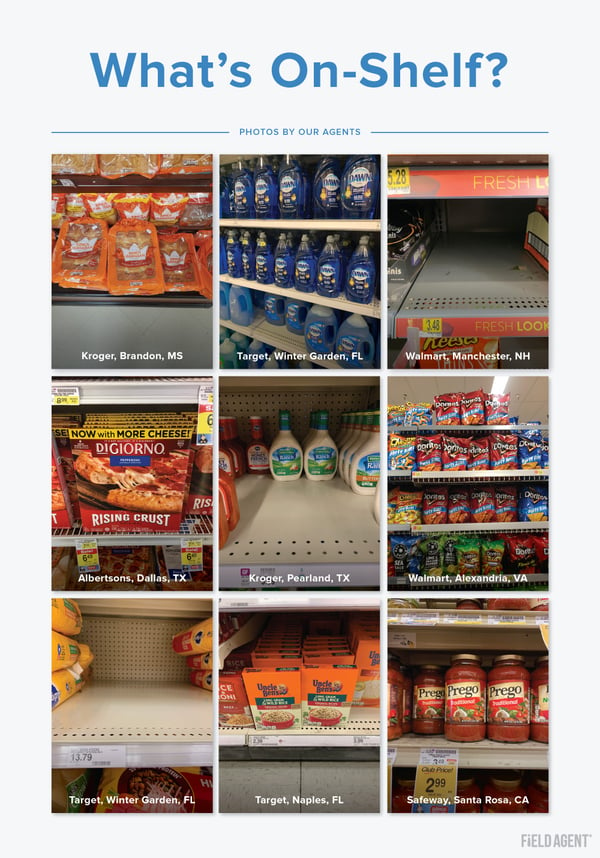

Through the Field Agent mobile app, we required agents to take photos of the products above and to count the number of units currently available on-shelf. Agents counted only the number of units on the aisle where the product is normally found, and did not count units also available on product displays.

Roughly half of OSA/OOS audits occurred on a Saturday afternoon/evening, while the other half took place on a Sunday afternoon/evening.

So what did we learn?

Below we present three fast facts highlighting key findings.

3 Fast Facts: OSA/OOS

1. OSA varied considerably for a single product

After accounting for products not carried by specific stores, Field Agent ultimately audited each product between 58 and 75 times. For example, we audited Dawn dishwashing liquid in 74 different stores and Doritos chips in 71 different stores.

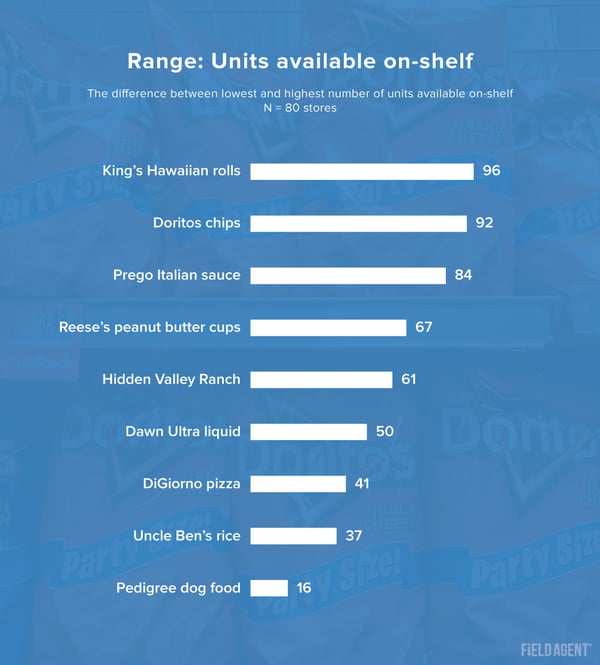

Most striking: the variability across stores for a single product.

The chart below displays the range for each product in the audit, or the difference between the lowest and highest number of units available on-shelf.

For instance, while five stores didn't have King's Hawaiian rolls in-stock at all, one store had 96 units (i.e., bags) on-shelf. Or, consider that while one store had only one unit of Doritos on-shelf, another store in the audit was found with 93 units.

That's quite the swing.

2. Stock-levels also varied a good deal across retailers

But what about OSA across retailers? Are stock-levels similar or dissimilar from one retailer to another?

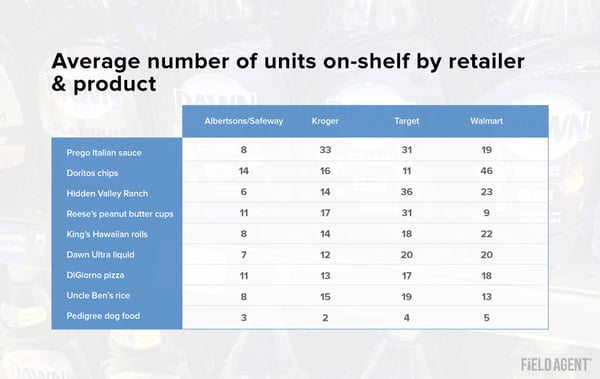

For that, we turn to the table below.

Here, too, the variance is worthy of our attention. For instance, Walmart was found to carry 46 units of Doritos (on average) compared to Super Target which was found to carry only 11. Since they represent the retailers with the highest and lowest averages, respectively, that's a range of 35 units.

Other products with noteworthy ranges across retailers:

- Hidden Valley Ranch: 30-unit range

- Prego Italian sauce: 25-unit range

- Reese's peanut butter cups: 22-unit range

Clearly, OSA can look very different across retailers.

3. Out-of-stocks represented 5% of all audits

Field Agent ultimately conducted 638 unique OSA audits (number of products audited by number of stores).

Of these 638 audits, we uncovered 29 out-of-stocks. That's about 5%.

On one hand, a small number.

On the other hand, a number like 5% means that a shopping trip to purchase 100 items will be marred by approximately five OOSs. Frustrating. And, of course, during periods of heavy shopping, we can reasonably expect a higher OOS rate.

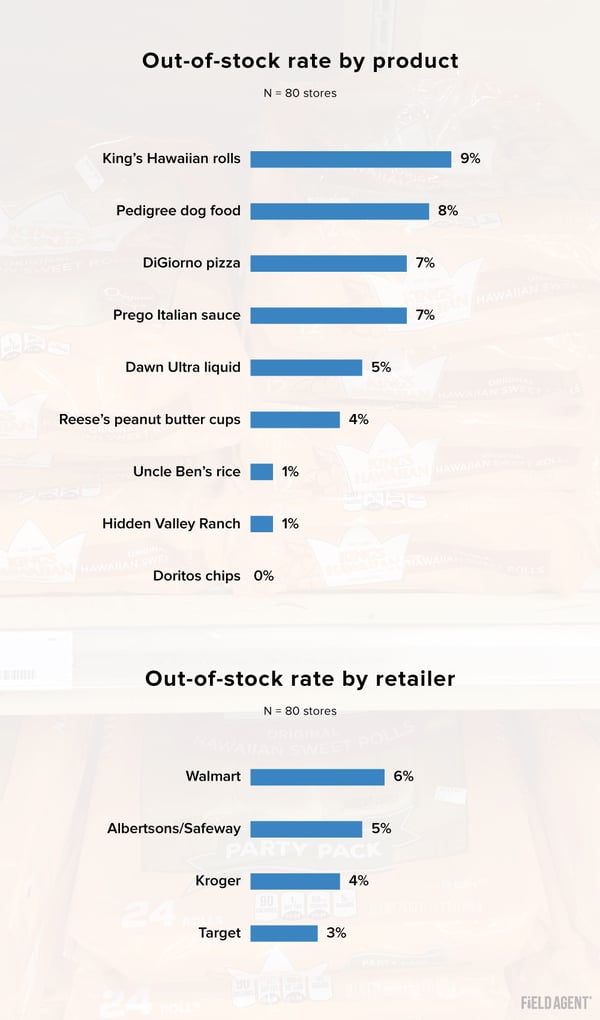

The charts below display OOS rates by product and retailer.

King's Hawaiian rolls, Pedigree dog food, DiGiorno pizza, and Prego Italian sauce all came in with OOS rates above the average of 5%, while Doritos enjoyed a 0% OOS rate.

Parity was the norm among retailers, with Super Targets registering the lowest OOS rate (3%) and Walmart the highest (6%). Of course, retailer OOS rates may be influenced by differences in sales volume from one retailer to another.

In conclusion, this data-driven look at OSA suggests (a) stock-levels vary considerably for a single product; (b) stock-levels also vary considerably across retailers; and, (c) out-of-stock rates, while relatively low, are likely a common occurrence for shoppers stocking-up on groceries.

Of course. OSA is just one important part of the overall brick-and-mortar, customer experience (CX). But it's certainly not the only part.

Download "Kroger X: Inside the Customer Experience at Kroger" (see below) to explore the CX at a chain with 2,758 grocery stores.

Retail Solutions for Any Challenge

Special Report: Kroger X

Based on audits and mystery shops at 61 Kroger stores across the country, "Kroger X: Inside the Customer Experience at Kroger" offers insights and information on several dimensions of the retailer's CX, including:

- Store navigation

- Prices and perceptions

- Store brands

- Customer service

- Checkout times

- Online shopping

- Pickup experiences

- Produce freshness

Download this free report today to start exploring the CX at Kroger!