Taking Stock of Coronavirus: On-Shelf Availability, Out-of-Stocks

Perhaps you’ve noticed? Coronavirus is in the news. Understatement of the year.

And as many headlines are now making clear, the spread of COVID-19 poses a formidable challenge to retail and supply chain systems across the board. Particularly in two related areas: on-shelf availability (OSA) and out-of-stocks (OOS).

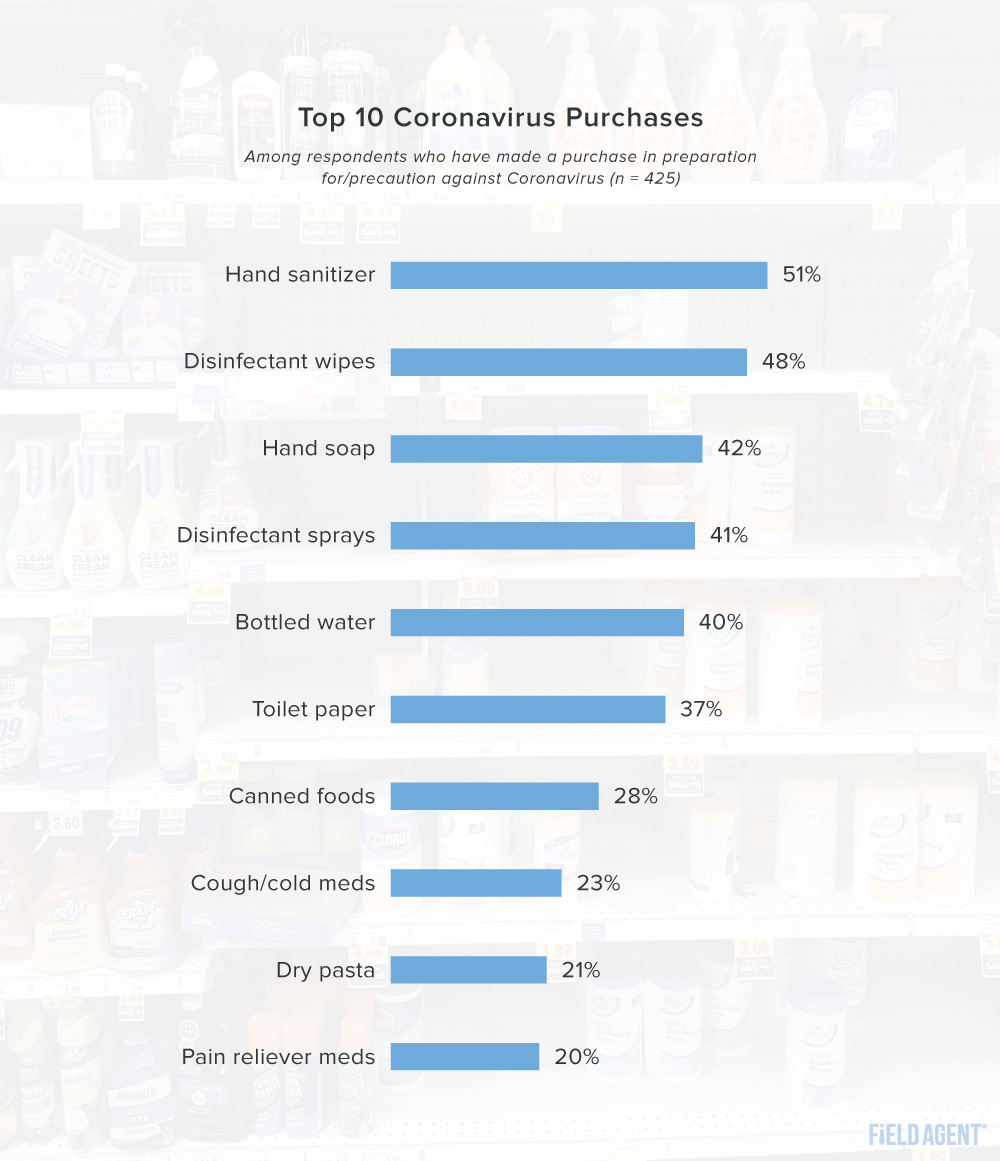

In a March 10, 2020 Field Agent survey, 29% of 1,500 respondents said they have already made a non-routine purchase of at least one item specifically in preparation for and/or precaution against the spread of COVID-19. In other words, virtually 3-in-10 respondents made a purchase they probably wouldn’t have without the specter of the virus looming. Notably, most of these respondents are living in areas so far minimally impacted, or virtually not impacted, by coronavirus.

So what are they buying?

Of 425 respondents who have made specific, non-routine purchases in preparation for coronavirus, hand sanitizer, disinfectant wipes, hand soap, disinfectant sprays, and bottled water were the most common acquisitions.

The chart breaks it down.

This all raises a question: As concerns about coronavirus spread, how will key product categories—sanitizer, soap, disinfectant—hold up to surging demand among customers? Especially in COVID-19 hotspots like Washington, California, and New York?

For an early indication, let’s look at the results from a multi-store, on-shelf availability/out-of-stock audit by the Field Agent platform.

Stores VS Coronavirus: On-Shelf Availability & Out-of-Stocks

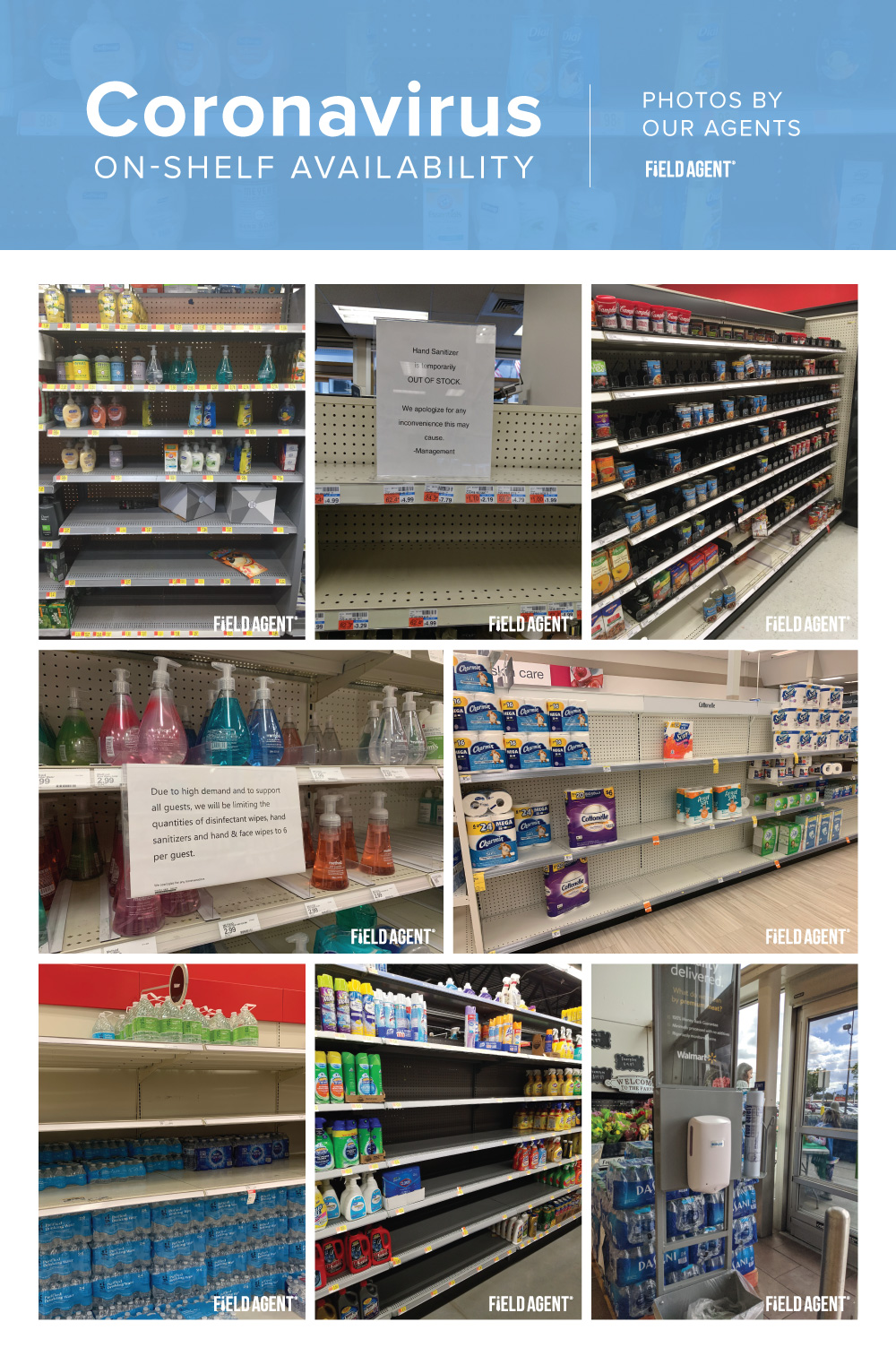

This weekend, the Field Agent platform deployed agents to a variety of stores* across the country to inspect on-shelf availability and out-of-stocks on a selection of key categories: hand soap (in pumps), disinfectant wipes, toilet paper, bottled water, and canned soup.

*Here are the retailers audited by the Field Agent platform alongside the number of stores audited for each retailer: Walmart (14 stores), Albertsons/Safeway (14 stores), Kroger/Kroger banners (11 stores), Walgreens (11 stores), Target (10 stores), Costco (10 stores), CVS (10 stores), Sam's Club (8 stores), Ahold Delhaize banners (6 stores), Publix (6 stores).

We ultimately audited 100 stores, weighting the selection of stores more heavily to the West Coast where COVID-19 made the strongest initial landfall in the U.S.

As the images in this article demonstrate, the Field Agent platform instructed agents to capture photos of all five categories above and, for each, to report one of the following stock-level conditions:

- Completely or almost completely stocked (i.e., approx. 91-100% stocked)

- Mostly stocked (approx. 61-90% stocked)

- About half stocked/half out-of-stock (approx. 41-60% stocked)

- Mostly out-of-stock (approx. 11-40% stocked)

- Completely or almost completely out-of-stock (approx. 1-10% stocked)

Below we offer three quick takeaways from the results.

COVID-19 OSA/OOS Audit: 3 Takeaways

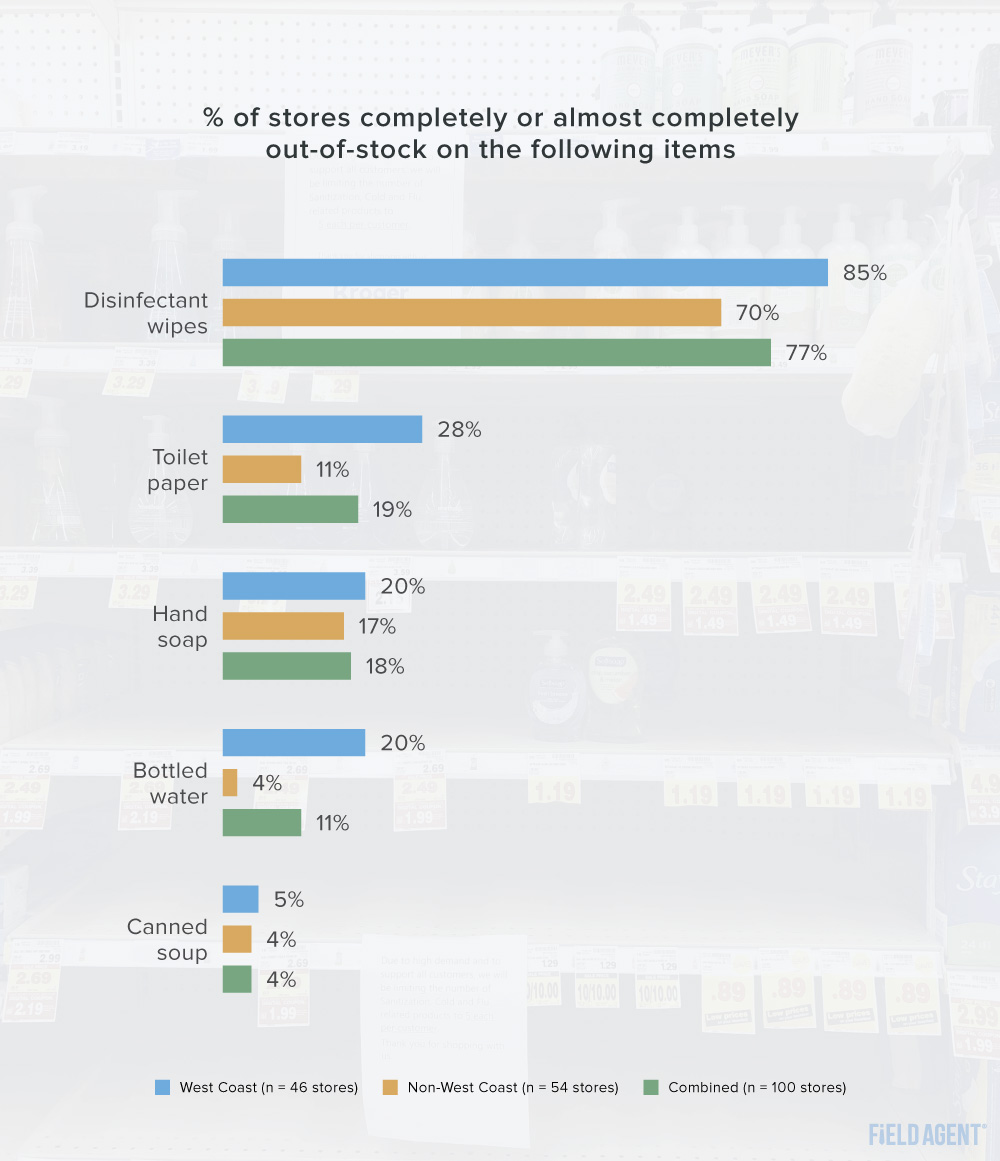

1. There's a run on disinfectant wipes

Of the five product categories audited by the Field Agent platform, disinfectant wipes were, easily, the hardest category hit. Many shelves dedicated to Clorox and Lysol wipes are currently barren wastelands, especially on the West Coast.

As the pie chart shows, the out-of-stock rate on disinfectant wipes was 85% across 46 stores in California, Oregon, and Washington.

But, in the wake of the coronavirus outbreak, the West Coast isn't the only region dealing with high OOS rates on disinfectant wipes. Outside California, Oregon, and Washington, audited stores showed a 70% OOS rate on disinfectant wipes.

2. Those shelves are looking bare

The chart below displays OOS rates across all five categories, showing results both on and off the West Coast.

On the West Coast, OOS rates on disinfectant wipes, toilet paper, hand soap, and bottled water were all 20% or higher, somewhat greater than the 5% average we found in a general OSA/OOS audit recently. OOS rates outside California, Oregon, and Washington aren't drastically better for disinfectant wipes and hand soap.

Washington and California, in particular, are really hurting for some products. The Field Agent platform ultimately audited 24 stores in California and 19 stores in Washington.

Stores audited in Washington state are presently dealing with an OOS rate of 95% on disinfectant wipes compared to 72% outside Washington and California.

In California, stores audited by the Field Agent platform are contending with an OOS rate of 42% on toilet paper and 33% on bottled water. Compare this to an OOS rate of 11% (toilet paper) and 4% (bottled water) outside CA/WA.

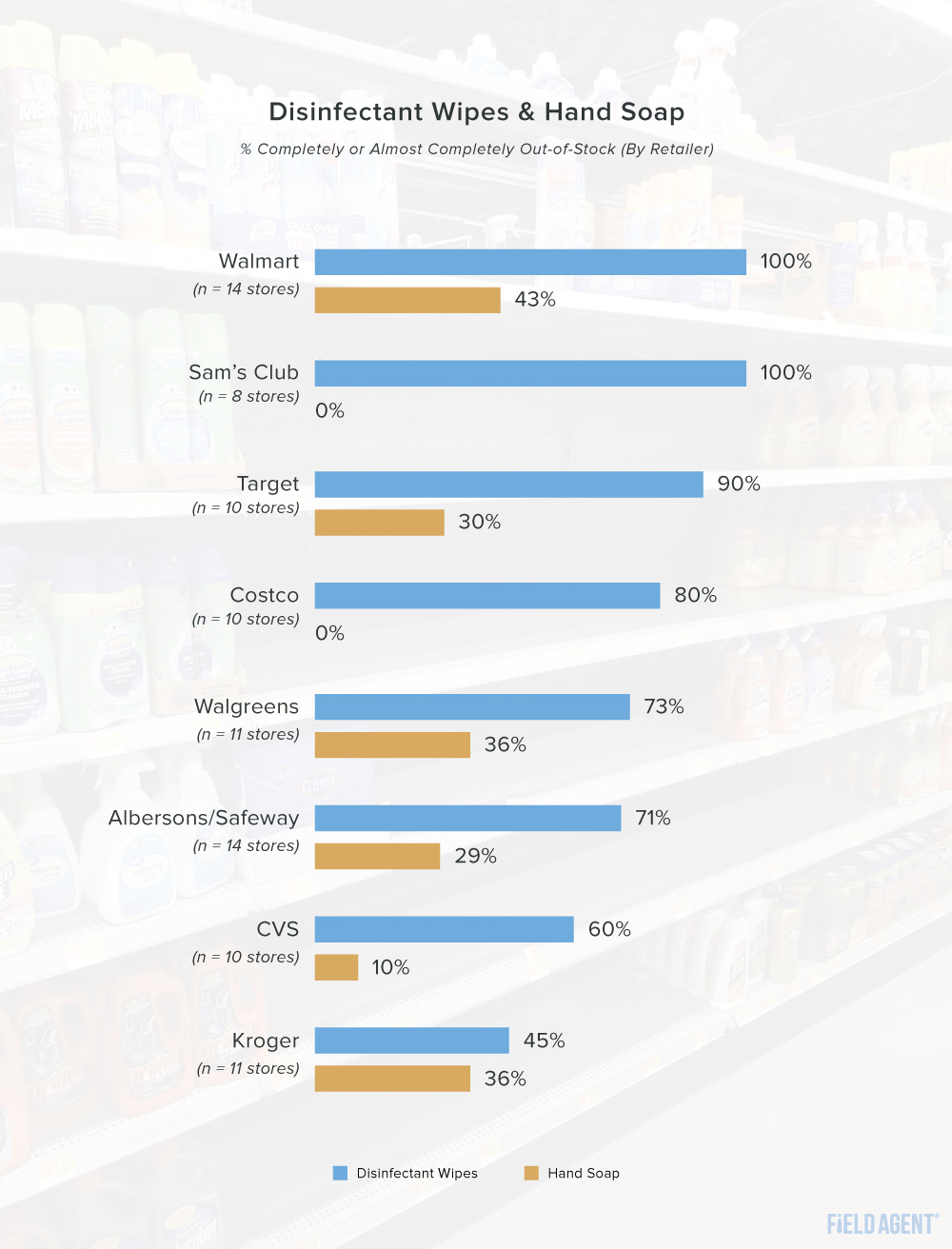

Out-of-stock rates may also ebb and flow by retailer. See the chart below for a basic indication of how OOS rates on a couple of key coronavirus-era categories may fluctuate from one retailer to another. The chart displays the results for all 100 stores, including stores both on and off the West Coast.

Walmart and Sam's Club both registered 100% OOS rates on disinfectant wipes.

Of course, OSA/OOS is directly related to sales volume, and since sales volume varies across retailers, we can reasonably expect higher OOS rates at some retailers than others.

3. Coronavirus is cause for stock-up and special store trips

Here's a question: Are shoppers making special trips to stock their coronavirus kits, or are they simply throwing these items into their carts as they shop for other groceries/household consumables?

Going back to the Field Agent survey of 1,500 U.S. adults, 249 respondents, or 17%, said they had purchased one of the following items specifically in preparation for/precaution against COVID-19:

- Hand sanitizer

- Hand soap

- Disinfectant wipes

- Disinfectant sprays

These 249 respondents received a follow-up question to help us understand how they purchased one or more of these items.

Altogether, 43% said they purchased at least one of the germ-killing products above as part of a larger stock-up trip, while 24% said they made a special store trip to purchase only sanitizer/soap/disinfectant. Another 30% said they've done both since the outbreak, and 3% indicated they made their purchases only online.

So it seems coronavirus is a cause for both stock-up and special store trips.

Of course, with a virus going around, many will try to bypass stores altogether. After all, we live in the age of curbside grocery pickup and grocery delivery. For an up-close look at the OGP phenomenon, download our Inside OGP report below.

Special Report: Inside OGP

Ready to go inside the shopping trend transforming how so many people shop for groceries?

Based on mystery shops of 84 pickup operations across four major retailers, Field Agent’s free report, “Inside OGP: Insights into 7 Pressing Questions about Online Grocery Pickup,” offers a data-driven, shopper-centered look at the OGP operations of Amazon/Whole Foods, Kroger, Target, and Walmart. The report deals with questions like:

- What do OGP users think about the online shopping experience?

- How fast are OGP deliveries?

- What do OGP users think about pickup sites and personnel?

- Are OGP users happy with the quality of their fresh produce?

Download this free report today, and go inside OGP today.