7 Ways Lawn & Garden Brands Can Make Their Sales Bloom

All kinds of things bloom in the springtime

Flowers. Plants. Sales.

We threw in that last one for the many lawn and garden (L&G) brands out there. After all, spring is the make-or-break moment for weed killers, fertilizers, pesticides, seeds, and many other L&G products.

“Eighty percent of the year’s business in just three months,” according to one CPG professional in the L&G category.

Survey data, too, attest to the enormity of the spring shopping season.

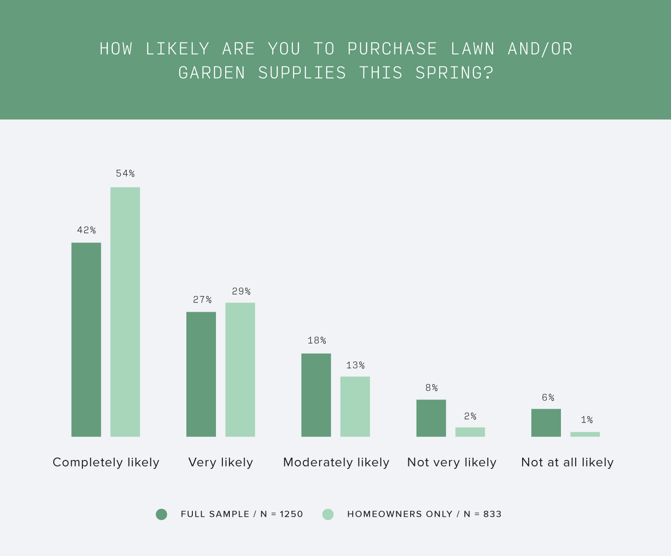

Seven-in-ten (69%) U.S. adults said they’re completely or very likely to make L&G purchases this spring, according to a survey of 1,250 U.S. adults conducted February 12, 2022 through the Field Agent on-demand platform. This figure sprouts to 83% when we filter the results for only homeowners (n =833).

*All survey respondents were U.S. adults at least 18 years of age and smartphone owners. The survey was executed through the Field Agent platform, February 12, 2022, with a non-random sample of shoppers. Demos: Gender - Female (73%), Male (27%), Age - 18-20 (1%), 21-29 (16%), 30-39 (37%), 40-49 (25%), 50-59 (16%), 60+ (6%); Household Income - < $35K (20%), $35-49K (17%), $50-74K (22%), $75-99K (16%), $100K+ (24%); Race/Ethnicity - Caucasian/White (64%), Latino/Hispanic (16%), African American/Black (14%), Other (6%).

Moreover, only 14% (or 3% of homeowners) said they’re not very or not at all likely to make L&G purchases this spring.

Although category and regionality can influence L&G sales, “...overall, every retailer and brand [in the L&G category] will win or lose based on how they perform in spring,” said another L&G brand professional. “This is especially true for ‘gardening’ categories within Lawn and Garden.”

So, clearly, L&G brands cannot afford to wilt when the spring rolls around. Which begs the question: What can brands in the L&G category do to grow their sales?

Below we discuss just 7 principles, based on discussions with L&G professionals and other CPG experts.

How Can Lawn & Garden Brands Grow their Retail Sales?

Be ready before temperatures rise

Help your buyer/retail partner win

1. Be ready before temperatures rise

When we asked our L&G brand professionals what companies can do to increase sales, both immediately emphasized the importance of being ready early.

“Be ready [in the winter],” one CPG insider said. “You’ve got to solidify your in-store execution before spring starts.”

And not just because it pays to be squared away either, but because shoppers are assembling their purchase options well before the temperatures rise.

“Two key factors in delivering a successful season,” another L&G professional stressed, “[are] creating awareness early, when shoppers are exploring options, and then being highly visible at the May sales peak.”

The bottom line: The early bird gets the worm, and not just in the lawn and garden. In the Lawn & Garden category, too.

2. Execute! Execute! Execute!

If you’ve read our CPG Guidebook to Q4 Success or our ebook, 20 Strong-Start Tips for CPG Brands in 2022, you know Field Agent emphasizes the retail success formula of:

Inventory + Space + Execution = Retail Success

- Inventory - Because you can’t sell what isn’t there

- Space - Because brands that dominate the shelf/floor will sell more units

- Execution - Because a retail program is only as good as its execution

Just before and during spring, vigilant execution is the single best way to impact L&G sales.

It may be too late to sell more cases to retail partners in any impactful way, but brands can still boost sales by ensuring their program is implemented correctly in stores. In the chain store age, after all, mistakes with products, prices, promotions can spread to thousands of stores—greatly affecting sales performance.

L&G brands, then, should be proactive about making sure retail partners are executing their program correctly. Display audits, price checks, and on-shelf availability are the name of the game during the all-important spring months.

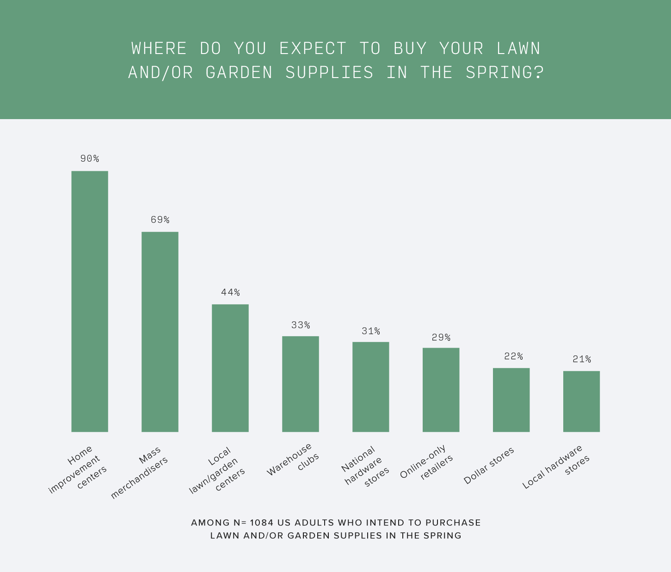

While more purchases are moving online, retailers with considerable brick-and-mortar operations still receive the lion’s share of L&G purchases.

As you can see below, in our survey of 1,084 individuals who expect to buy L&G supplies this spring, home improvement centers, local nurseries, and mass merchandisers dominate online-only retailers like Amazon for L&G purchases.

Consequently, L&G brands simply can't afford to neglect the execution of their in-store retail program, even in the digital age.

The bottom line: There’s no better way to impact sales just before or during the spring than to ensure effective in-store execution.

3. Stand out in-store and online

For L&G brands, the significance of the point-of-purchase—in-store and online—cannot be overstated. This is especially true just before and during spring, when green-thumbed shoppers are in buying mode.

Inside stores, P.O.P. materials like displays can get your products closer to shoppers and make them stand out from the masses of other L&G labels. That is, as long as those displays are properly executed, which is why display audits like this one can be real difference-makers for L&G brands during heavy-volume seasons.

And P.O.P. materials can really make a difference.

Of shoppers at least moderately likely to make L&G purchases this spring (n = 1,084), 86% said promotional product displays (stand alone or endcap) will be at least moderately influential over their in-store L&G purchases this spring. Thirty-five percent said they'll be extremely or very influential.

Of course, there's also the online point-of-purchase. Here, L&G brands should be proactive about ensuring they have the right amount of reviews available for purchase-minded shoppers to read.

In our survey, 52% of L&G shoppers (n = 1,084) said they're either completely or very likely to read online reviews this spring prior to making L&G purchases—whether those purchases are online or in-store. Eighty-four percent are at least moderately likely.

In other words, for many L&G brands, online ratings and reviews have gone from a nice-to-have to a must-have, and solutions like these are making it simple and easy to gather reviews in a hurry and on a limited budget.

The bottom line: In-store and online, fortify the point-of-purchase with the assets that can push shoppers over the edge—to pick your product amid a sea of other choices.

4. Win next spring now

Execution is only one element of the retail success formula; inventory and space are also of fundamental importance.

Once spring has sprung, it’s mostly too late for L&G brands to lay claim to more floor space, shelf space, or promotional displays inside stores. As seen, the time for selling more cases to retailers has also largely passed.

But this spring is the time to win next spring.

Specifically, springtime is the time for L&G brands to collect information and insights to help them make a convincing case to retail partners for more units, more shelf space, and more displays come next spring.

Throughout the spring, it's a good idea to…

- Capture in-store information and photos to prove to your buyer you could have made more sales for the retailer—had you been given more space in stores this season

- Collect insights into the L&G shopper, specifically, how they shop the category in-store and where they’re underserved

Then, combine this objective information into a case for more space and inventory during the sales phase leading up to next spring.

The bottom line: This spring is not just about this spring. It’s about the years to come.

5. Make ready for millennials

Both of our L&G professionals were vocal on this point: The L&G market is shifting, as more millennials (ages 26 to 41 in 2022) find their stride as homeowners and, yes, lawnkeepers and gardeners.

I’ll let one of our brand representatives explain:

Winning in Lawn & Garden for the next decade is going to require a balance between catering to older shoppers in the category, which represent the majority of the volume, while embracing millennials entering the category, which represent the majority of the category’s growth.

There is a significant variance in what drives purchase behavior between the two groups, and successful brands will find ways to bridge that gap.

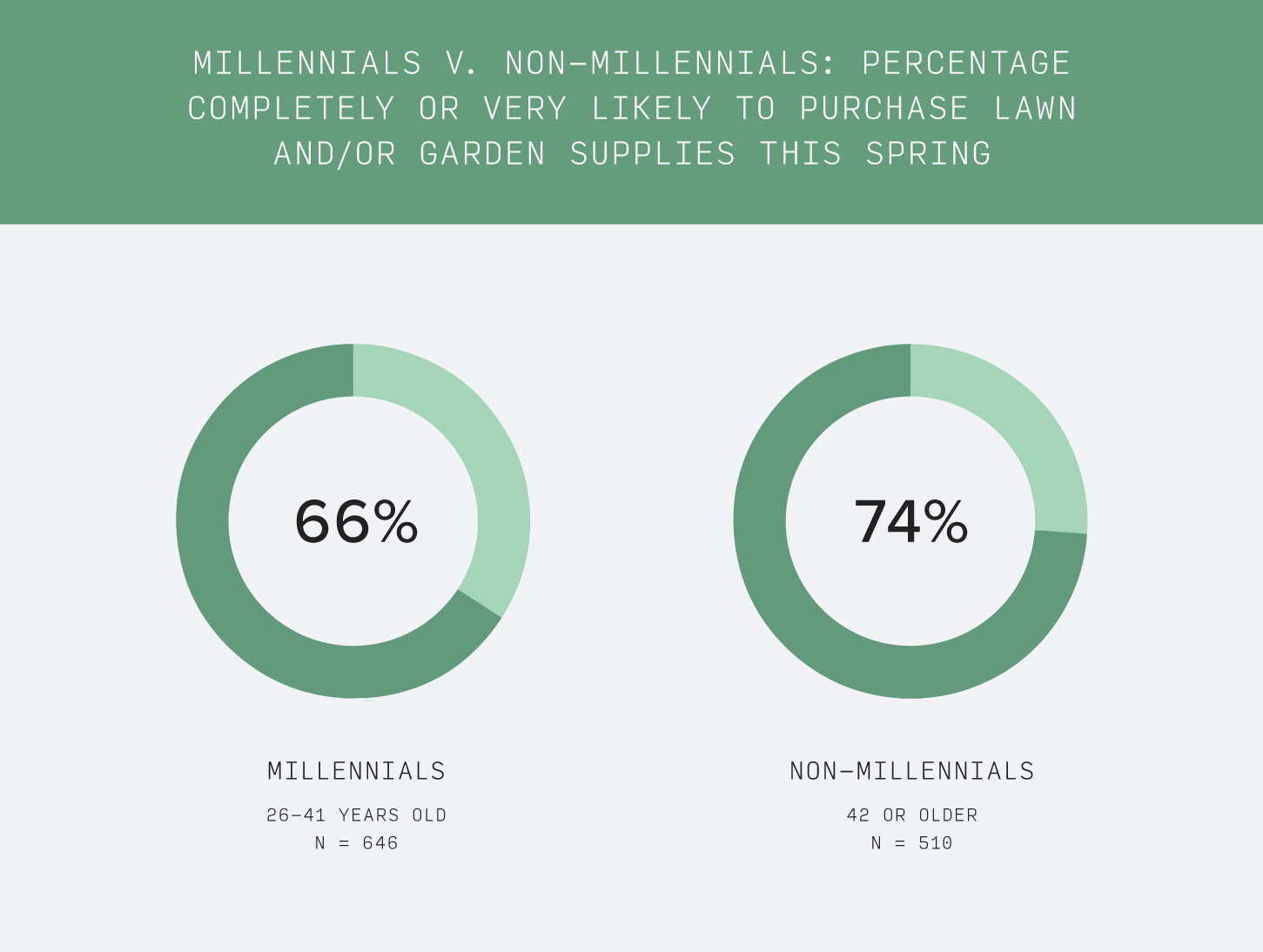

In our survey, 74% of non-millennials (ages 42+) were completely or very likely to make L&G purchases in the spring.

Given we often think, rightly or wrongly, of older Americans as the real L&G enthusiasts, what would be the drop-off for millennials? As it turns out, not very much. Sixty-six percent of millennials (ages 26-41) indicated they're completely or very likely to make L&G purchases this spring.

Welcome to the L&G category, millennials.

So how can brands win with millennials? The L&G professional continued...

...without a doubt, finding paths to connect with [millennials], on the platforms they engage in, is critical. Brands that reach millennials with a compelling story, as to ‘why me’ and help educate them as to the ‘how to,’ have the best chances to succeed.

Of course, being able to target millennials with a “why me” and “how to” story is predicated on first understanding millennials. And this spring, when millennial shoppers are in-store and online, and when they have L&G on their minds, is the best time to collect insights and information about their L&G shopping habits, attitudes, and experiences.

You might even consider a shopalong or two will millennial L&G shoppers.

The bottom line: L&G brands should take every opportunity to understand and create value for millennials, who will account for much of the category growth ahead.

6. Help your buyer/retail partner win

In our Buyer Meeting Success Kit, we described 12 tips for a successful buyer meeting—one that culminates in mutual, long-term benefits for both brand and retailer. Tips like:

- Be data-driven

- Know your industry, category, and customer

- Have a category mindset

- Build trust and empathy

- Know what a “win” looks like

- Help the buyer win

For L&G brands, spring is an opportunity to earn critical trust and credibility with buyers. Trust and credibility that can position the brand for sales growth for the years ahead.

This spring...

- Will you take advantage of the opportunity to learn about L&G shoppers—and share these insights with your buyer?

- Will you use the days ahead to become more knowledgeable about your category and competitors, so you can discuss matters with your buyer more knowledgeably?

- Will you be on the lookout for opportunities that can help your buyer grow their category and win with their employer?

Don’t miss the chance to make positive, meaningful, sincere inroads with your buyer this spring—because the opportunity really only comes once a year.

The bottom line: Spring is a unique, once-a-year opportunity for L&G brands to earn trust and credibility with retail buyers in the category.

7. Think beyond spring

We emphasized the importance of spring to retail success in this article. And rightly so. Spring is to L&G brands what Christmas is to toy brands.

But spring isn't all there is. “How do you extend into June and July?," asked one of our L&G professionals. "How do you extend sales into the rest of the year?”

With the rise of the millennial L&G shopper, companies may find strategic opportunities to sell year-round.

For instance, what about in-home gardening?

It's on this rise, and, for entrepreneurial L&G brands, a possibility with great long-run potential. If they're watchful, opportunistic, and aggressive.

To the victor go the spoils.

The bottom line: Don't be so fixated on just the spring that you don't see growth opportunities that could extend well into other parts of the year.

All The Tools for Springtime, Retail Success

What do you need to grow sales for your lawn and garden brand? Audits, insights, online reviews, merchandising, on-demand sales, brand photography, SEO content?

They’re all available in the Field Agent Marketplace. Every one of them.

All the retail solutions in our marketplace are streamlined for fast, simple, affordable purchase and execution. No contracts, no conversations. Just click and launch.

And make it a successful spring.